Will US and China EV Emperor's New Clothes-Like Investments Join Covid To Take Down The World's Economy?

SEE ALSO: Electric Cars Solution Or Diversion?

The Start Of The Crash?

Reuters Update 9/24/2021; S.Korean stocks post weekly decline as Evergrande debt woes continue

Reuters Update 9/23/2021; Evergrande bondholders seek clarity on payments after hope fades on Thursday deadline

Editor's Update (9/20/2021) ;Seems like the emperors new clothes is the model to make money, as the two smart Brooklyn Guy co-founder's of The Auto Channel struggle to keep the lights on, we can't believe the stupidity (dishonesty?) surrounding the belief of a ubiquitous (and uber profitable) penetration of EV's here in America instead of recognizing the actual ready for prime time renewable domestic freedom fuel alternative that is ready now to replace the never gonna happen EV fairy-tale.

The list of additional links to stories that prove our point that have been published and archived on The Auto Channel during the past 25 years is too massive to include within this article. So if you really give a shit about why we believe that EV is bull, and wish to have access to our research so you can put the story together for yourself, click over to the China EV archive or the Electric Vehicle News archive and discover the truth...if you thought Madoff scammed, you ain't seen nothing yet.

TACH's TAKE: Electric Vehicles - An Honest Alt-Fuel Solution? Or A Chinese World EV Domination Tulip-like Frenzy?

MORE: From Bankrupt To Ok With Chinese Government Reliant Evergrande Health, a unit of property developer Evergrande Group, which paid HK$6.7 billion (US$854 million) last month for 45 per cent of the cash-starved start-up. Investor Save the Faraday Future

MORE: China EV Monopoly Aided By "Tra-la-la" US Politicians - Nine U.S. States Pressure Automakers on EVs

MORE: China Forces Car Makers To Go Electric: Starting in January, all major manufacturers operating in China—from global giants Toyota Motor and General Motors to domestic players BYD and BAIC Motor—have to meet minimum requirements there for producing new-energy vehicles, or NEVs (plug-in hybrids, pure-battery electrics, and fuel-cell autos). A complex government equation requires that a sizable portion of their production or imports must be green in 2019, with escalating goals thereafter.

MORE: Bloomberg reported that although Automakers historically and typically want their cars to stand out, China’s push for greener vehicles is prompting Toyota, Fiat Chrysler, Honda and Mitsubishi to resort to an unusual move: they’re set to sell the same car. The four carmakers all plan to sell an electrified SUV developed by Guangzhou Automobile Group Co., the Chinese manufacturing partner they share.

MORE: Chinese Battery Deal Just Announced: NEC's Transfer of Lithium Ion Battery Business Allows Nissan To Sell Their Battery Business To Chinese Company Envision

MORE: Commentary: Freezing U.S. fuel standards is a gift to China's auto industry

China’s potential dominance in the changing auto sector matters. Auto manufacturing constitutes about three percent of U.S. GDP, and accounts for the most jobs of any manufacturing sector. Losing these jobs, and this market share, to another country is no laughing matter, especially in the auto-heavy Midwest and Southeast states: in Michigan, Ohio, and Tennessee, auto industry jobs make up 10 percent or more of the entire state labor force.

MORE: Just-in From Bloomberg: U.S., with eye on EVs, set to limit China investments

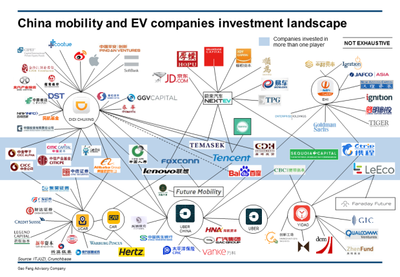

Real estate developers' entry bodes well for China's EV ambitions

Commentary By Yang Jian | 2018/8/17

SHANGHAI -- Since last year, several major Chinese real estate developers have placed a bet on electric vehicles. They see synergies to be generated between EVs and their existing business, rather than short-term financial gains.

Their investments will help Chinese EV makers better cope with high capital expenditures and weather potential market risks.

Among the investments real estate development companies have made in EV makers, the one that has received the most extensive media coverage was carried out by China Evergrande Group, China’s second-largest property developer ranked by sales.

And the target company -- Faraday Future-- is an EV startup founded by founded by Chinese entrepreneur Jia Yueting in Los Angeles. Until two months ago, Faraday Future was teetering on the verge of bankruptcy from a severe cash crunch.

In June, Evergrande Group arranged for a subsidiary, Evergrande Health Industry Group, to acquire 45 percent of Faraday Future for 6.7 billion Hong Kong dollars (5.9 billion yuan).

This week, Evergrande Health, now Faraday Future’s largest shareholder, opened a new company, Evergrande FF Intelligent Automotive (China) Co., in the south China city of Guangzhou with registered capital of $2 billion (13.8 billion yuan).

Faraday Future started assembling its first vehicle, the FF 91 luxury crossover, at a leased plant in Hanford, Calif., this month. And Evergrande FF is expected to start producing the vehicle at a factory now under construction in Guangzhou in the near future.

Evergrande Group has deep pockets to tap when it comes to financing Faraday Future’s EV output. It generated a net profit of 52 billion yuan on revenue of 304.2 billion yuan in the first half.

With the powerful backing of its parent, Evergrande Health plans to build five assembly plants in China with combined annual production capacity of 5 million EVs for Faraday Future over the next 10 years.

By investing heavily in Faraday Future, Evergrande Group expects to establish a leading presence in the fast-growing domestic EV market. It also expects Faraday Future’s EVs to complement Everagrande Health’s premium hospitals and community health care centers across China.

In addition to Evergrande Group, two other major Chinese property developers have diversified with forays into the domestic EV industry.

China Fortune Land Development Co., China’s largest industrial park developer and operator, in December acquired a 53.4 percent interest in domestic EV startup Hozon New Energy Vehicle Co.

In the same month, Baoneng Investment Group Co., purchased a 51 percent stake in Qoros, a small Shanghai carmaker to accelerate Qoros' EV development and production.

In addition to real estate development, Baoneng, a private business conglomerate, also runs health care, insurance, auto components production and car financing businesses.

In October 2017, Country Garden Holdings, China’s largest real estate developer, disclosed plans to partner with domestic battery makers and other parts suppliers to build a large component factory for EVs in Shunde of South China’s Guangdong province.

In 2015, Beijing started reining in domestic real estate investments in a bid to cool the overheated housing market. In the past few months, the government has further tightened control on property development in China’s major cities.

The policy shift will send real estate developers in general searching for business opportunities in other sectors, and more of these companies likely will join Evergrande, Fortune Land Development and Baoneng to make their way into the EV industry in one way or another as strategic investors.