The Look Ahead For The Car Industry

What’s in store for the Autos sector as we head into 2025? The attached S&P Global Ratings 2025 Autos Industry Outlook examines the sector’s risks, opportunities, trends, credit quality and outlook.

S&P Global Ratings | 2025 Credit Outlook: Autos

Cloudy Skies Loom Over Auto Industry

______________________________

Industry Credit Outlook: Autos

- Nishit Madlani, North American Autos Managing Director, S&P Global Ratings, says: “The debate surrounding tariffs on the import value of parts and finished vehicles into the U.S. is a focal point in the global auto industry. Meanwhile, the outlook for EV demand in the U.S. could face some downside pressure during Donald Trump's second presidential term. This will depend on the timing and magnitude of changes to consumer and production tax credits under the Inflation Reduction Act, as well as investments in charging infrastructure under the Bipartisan Infrastructure Law. We expect significant competitive pressure for all automakers in 2025 and 2026. Following a slowdown in market share gains for EVs and rising inventories for several models, we think the next wave of buyers will be more price-sensitive and depend on significant battery range improvements, charging infrastructure, and technology.”

- What's changed?

- Foreign carmakers are losing market share in China more quickly, while suppliers face pressure to diversify with domestic OEMs, which may reduce returns as they compete with local leaders.

- Trump’s second term as U.S. president revives fears of new trade tariffs on imported vehicles from Europe, Mexico, and Canada, complicating the challenging market for OEMs and suppliers.

- Europe's slowing EV adoption raises the risk of weaker margins for automakers due to uncertainty about government support for the transition through incentive schemes.

- What are the key assumptions for 2025?

- Global demand for light vehicles remains stable, although market shares are shifting to Chinese original equipment manufacturers (OEMs).

- Pricing is more resilient than expected, helped by production discipline, but will likely weaken in the U.S. and Europe due to a very competitive market and price-sensitive consumers.

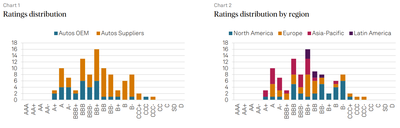

- Supplier ratings will be less resilient than OEMs since ongoing restructuring has not significantly improved deleveraging or profitability.

- What are the key risks around the baseline?

- Tariffs on U.S. imports of light vehicles and parts would require price adjustments, changes to product strategy, and selective relocation, likely negatively affecting profitability and cash flow.

- A stronger-than-expected economic slowdown fueled by low consumer confidence in the U.S. and Europe, decelerating growth in China and the risk of OEMs overproducing relative to demand.

- Delaying 2025 regulatory targets in Europe would ease pressure on OEMs to push electric vehicles (EVs), helping to stabilize prices and lower the risk of fines at least temporarily.