Deloitte: Holiday Travel Goes the Distance as Americans Plan More and Longer Trips

|

- Holiday travel intent continues to be strong: Half (49%) of Americans intend to travel between Thanksgiving and mid-January. Travelers expect to spend an average of $3,294 for their longest holiday trip, and their seasonal travel budget is 4% higher than in 2023.

- Travel budgets are up for 28% of American travelers, and the share of budget increasers saying that "Travel has become more important to me" has doubled since 2023.

- Holiday travelers plan to take 2.14 trips, up from 1.88 last year, and 33% are planning vacations of a week or longer, compared to 25% in 2023.

- Younger and higher-income travelers are largely driving travel this season. Two-thirds of higher-income Americans plan to travel, and all generations, aside from Boomers, plan for higher frequency and spend. Millennials plan to spend the most ($3,927).

- "Laptop lugging" makes its first jump since 2021, as 49% of employed travelers intend to work, at least partially, on their longest leisure trip of the 2024 holiday season, up from 34% last year.

Why this matters

Holiday travel has found a steady cruising altitude, and it may ascend even higher this season. For the fourth consecutive year, Deloitte has examined travel intent ahead of the holiday season and its potential impact on the industry. According to this year's report, "2024 Deloitte Holiday Travel Survey," Americans continue to prioritize travel, mapping out a positive opportunity for providers this holiday season and beyond.

Holiday travel spending takes off

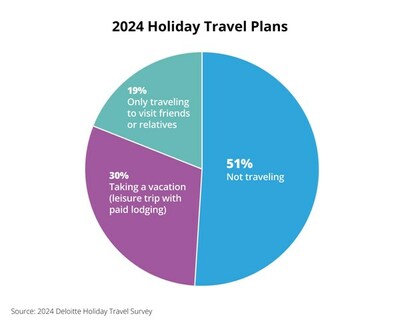

The number of Americans planning to head home — or elsewhere — for the holidays remains steady. Nearly half (49%) of Americans plan to travel during the 2024 holiday season, compared to 48% in 2023. However, frequency and budgets for these holiday trips are increasing as travel becomes a greater priority across the board.

- Americans who plan to travel expect to take 2.14 trips this season compared to 1.88 in 2023, the highest since travel resumed post-pandemic. Budgets are also up, as 28% (versus 18% in 2023) plan to significantly increase their budgets for their longest trip this year. Americans expect to spend an average of $3,294 on their longest holiday trip.

- Among those increasing their spend, 4 in 10 say that travel has become more important to them, making it the primary reason for bigger budgets this holiday season.

- Planned travel is concentrated around two major holidays with 3 in 10 Americans planning to travel over Thanksgiving, and a quarter planning a trip around the December holidays.

- Although fewer trips are planned for later in the season, those trips tend to be longer. Among those traveling in early- to mid-January, 36% plan to take a trip lasting a week or more, compared to just 16% at Thanksgiving.

- All generations aside from Boomers are planning for higher trip frequency and spend, with millennials planning to spend the most ($3,927) and take the most trips (2.6).

- There is a notable rise in travel intent among higher-income Americans (those earning $100,000 and above) — 66% plan to travel in 2024, up from 59% last year. They will make up over half of paid lodging travelers (52%) this holiday season.

- While 46% of Americans say they are doing better financially, up from 31% in 2023, the reasons for not traveling this season remain largely unchanged: 39% say they cannot afford it (similar to the 38% who said the same in 2023) and 31% say travel is too expensive right now (versus 32% in 2023).

Key quote

"Enthusiasm for holiday travel keeps climbing as travelers look to make the most of the season by visiting friends and family. An increase in trip frequency is pushing budgets up, giving travel providers the opportunity to capitalize on festive experiences. Travelers who invest in their holiday memories could create the groundwork for loyalty that stays long past the new year."

— Kate Ferrara, vice chair and U.S. transportation, hospitality and services sector leader, Deloitte

Personal preference drives decisions, creating opportunities to build loyalty

Travelers are seeking out personalized, upgraded experiences, creating an opportunity for providers to drive loyalty this holiday season.

- Nearly 1 in 5 plan to fly during Thanksgiving or Christmas, and 30% plan to stay in paid lodging, including hotels or private rentals.

- Those planning to increase budgets are making plans to splurge on longer trips (49%), better lodging locations (44%) and upgraded airfare (29%).

- Over half (52%) of holiday travelers plan to take a domestic flight at least once this holiday season, compared to 24% flying internationally. Road trips have also seen a resurgence as 65% of holiday travelers plan to take one.

- More travelers are using social media apps to plan their holiday trips (39% versus 27% in 2023). The number of travelers leveraging short social video content and GenAI tools is also up — 27% versus 16% in 2023 and 16% versus 8% in 2023, respectively.

Laptop lugging ascends again

As more Americans place a greater value on their travel plans, working while traveling or "laptop lugging," makes a significant jump this holiday season for the first time since 2021.

- Half (49%) of travelers intend to work, at least partially, on their longest leisure trip of the holiday season, compared to one-third (34%) last year.

- Laptop lugging is largely driven by younger- and higher-income travelers: 58% of Gen Z travelers and 54% of millennials plan to partake, while 52% of high-income travelers say the same. However, the trend is up across all income levels and age groups.

- Remote work continues to enable holiday travelers to take more seasonal trips and extend them. Laptop luggers plan to take an average of 2.7 trips this season compared to just 2 trips for those planning to disconnect entirely. Those who plan to work remotely will also extend their longest trip by an average of three days.

- Laptop luggers are also more inclined to travel internationally, with 3 in 10 planning to do so compared to 18% of disconnectors. The most popular longest-trip destinations for international laptop luggers are Europe (41%), Mexico (20%) and Canada (14%), mirroring the general population's choices (Europe: 36%, Mexico: 23% and Canada: 14%).

Key quote

"Travelers are finding ways to make their holidays happen, their way. Younger travelers are splurging on upgraded experiences; remote work continues to enable longer, more frequent trips; and everyone is looking for good food and plenty of options. The travel industry has a prime opportunity to tap into these trends to help drive lasting loyalty this holiday season."

— Eileen Crowley, U.S. transportation, hospitality and services, partner, Deloitte & Touche LLP

Deloitte's "2024 Holiday Travel Survey" is based on a survey of 4,074 Americans fielded between Sept. 17 and Sept. 23. Of these, 2,005 respondents who are planning to travel between Thanksgiving and mid-January qualified as holiday travelers.

About Deloitte

Deloitte provides industry-leading audit, consulting, tax and advisory services to many of the world's most admired brands, including nearly 90% of the Fortune 500® and more than 8,500 U.S.-based private companies. At Deloitte, we strive to live our purpose of making an impact that matters by creating trust and confidence in a more equitable society. We leverage our unique blend of business acumen, command of technology, and strategic technology alliances to advise our clients across industries as they build their future. Deloitte is proud to be part of the largest global professional services network serving our clients in the markets that are most important to them. Bringing more than 175 years of service, our network of member firms spans more than 150 countries and territories. Learn how Deloitte's approximately 460,000 people worldwide connect for impact at www.deloitte.com.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee ("DTTL"), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as "Deloitte Global") does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the "Deloitte" name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.

SOURCE Deloitte