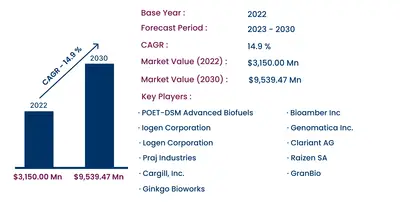

Cellulosic Ethanol Market to Hit US$ 9,539.47 Million By 2030 | Updated Analysis

|

New York, Sept. 13, 2023 (GLOBE NEWSWIRE) — The global Cellulosic Ethanol Market is expected to witness significant growth at a remarkable CAGR of 14.9% during the forecast period of 2023-2030. Factors such as the growing demand for sustainable and renewable energy sources, the high benefits of cellulosic ethanol over 1st generation ethanol, and others are accelerating the demand for cellulosic ethanol, which, in turn, is boosting the market growth. In addition, the growing initiatives for the development of cellulosic ethanol production plants will further boost the market growth during the forecast period.

Immediate Delivery Available, Buy Now @

https://www.consegicbusinessintelligence.com/secure-checkout/1248

Global Cellulosic Ethanol Market Segmentation Details:

Based on Feedstock, the agricultural residues segment contributed the largest shares to the market growth in 2022. The processing of agriculture residue leads to relatively lower greenhouse gas emissions due to which it is getting popular as the most effective and highly available feedstock for cellulosic ethanol production segment growth across the globe. Thus, the high availability and lower cost of conversion of agriculture residue is fostering the revenue growth of the cellulosic ethanol industry during the forecast period.

Based on Process, the dry grind segment contributed the largest shares to the market growth in 2022. The growth of the dry grind process in cellulosic ethanol is gaining popularity owing to the increasing research and development activities for the optimization of technologies. Hence, the high affordability and acceptance of dry grind process for cellulosic ethanol manufacturing is fostering market growth.

Based on the Application, the fuel & fuel additives segment contributed the largest shares to the market growth in 2022. Cellulosic ethanol is used as fuel & and fuel additives due to its higher octane number and premium blending properties in gasoline. Owing to these beneficial properties of ethanol as a fuel additive, government bodies across the globe are promoting ethanol blending in the fuel to lower the overall gasoline prices and increase sustainability in fuels. Henceforth, the utilization of cellulosic ethanol as a fuel additive is increasing which, in turn, is fostering market growth.

Get Sample Report@ https://www.consegicbusinessintelligence.com/request-sample/1248

Based on End-user Industry, the transportation segment accounted for the largest market share in the year 2022. Cellulosic ethanol is a renewable fuel made from various plant materials collectively known as “biomass.” Ethanol is used as a fuel and fuel additive in the transportation industry. Gasoline contains 10% ethanol and 90% gasoline. Such a high content of ethanol in gasoline helps to reduce the air pollution caused by vehicle emissions. The increasing government initiatives to increase the blending of ethanol and gasoline to promote sustainability in fuel and reduce the dependency on fossil fuels are driving the segment growth.

Based on Region, in the year 2022, North America accounted for the largest share contribution to the market growth, owing to the increasing biofuel production across the region. The increasing investments in the production of sustainable biofuels across the region are accelerating the cellulosic ethanol market in the North American region. For instance, in January 2023, The U.S. Department of Energy (DOE) today announced $118 million in funding for 17 projects to accelerate the production of sustainable biofuels for America’s transportation and manufacturing needs.

Competitive Landscape

Raizen SA, Logen Corporation, GranBio, and Cargill, Inc. are major market players that comprise the latest market circumstances. These companies are substantially leveraging their technologies for the development of a new range of cellulosic ethanol. Further, the cellulosic ethanol market is expected to grow steadily due to growing initiatives for the development of cellulosic ethanol production plants, especially in regions such as the Asia Pacific, the Middle East, and Europe are estimated to boost the market statistics in the coming years. Additionally, the trend toward increasing expansion of cellulosic ethanol players in the international market is expected to increase the competition in the industry.

Recent Developments

- In November 2022, Raizen SA announced an investment of USD 1.23 billion for the construction of five new second-generation ethanol or cellulosic ethanol plants.

- In June 2022, Clariant AG announced that it had produced the first commercial cellulosic ethanol at its sunliquid production plant in Podari, Romania

- In August 2020, GranBio, and NextChem, announced a partnership to achieve global leadership in the licensing of patented GranBio 2G Ethanol technology to produce cellulosic ethanol.

Key Market Takeaways

- North America accounted for the highest market share at 36.10% valued at USD 1,137.15 million in 2022 and is expected to reach USD 3,462.83 million in 2030. Moreover, in North America, the U.S. accounted for the highest market share of 64.30% during the base year of 2022.

- Based on feedstock, the agricultural residues segment accounted for the highest share contribution to the cellulosic ethanol market statistics in 2022.

- In the context of process, the dry grind segment is expected to contribute significant shares to the growth of cellulosic ethanol market statistics during the forecast period.

- Based on application, the fuel & fuel additives segment accounted for the highest share contribution to the cellulosic ethanol market statistics in 2022.

- In the context of the end-user industry, the transportation segment is expected to contribute significant shares to the growth of cellulosic ethanol market statistics during the forecast period.

- Asia Pacific is expected to boost the market demand for cellulosic ethanol due to the increasing investments by the key players for the development of cellulosic ethanol manufacturing plants in countries such as India, Singapore, and others.

Browse Full Report & TOC @ https://www.consegicbusinessintelligence.com/cellulosic-ethanol-market

List of Major Global Cellulosic Ethanol Market:

- Raizen SA

- Logen Corporation

- GranBio

- POET-DSM Advanced Biofuels

- Iogen Corporation

- Praj Industries

- Cargill, Inc.

- Ginkgo Bioworks

- Bioamber Inc

- Genomatica Inc.

- Clariant AG

Global Cellulosic Ethanol Market Segmentation:

- By Feedstock

- Energy Crops

- Agricultural Residues

- Organic Municipal Solid Waste

- Forest Residue

- Others

- By Process

- Dry Grind

- Wet Mills

- Others

- By Application

- Industrial Solvents

- Fuel & Fuel Additives

- Beverages

- Chemical Additives

- Others

- By End-user Industry

- Transportation

- Energy

- Chemicals

- Others

Request for Customization @ https://www.consegicbusinessintelligence.com/request-customization/1248

Frequently Asked Questions in the Cellulosic Ethanol Market Report

- What was the market size of the cellulosic ethanol industry in 2022?

- In 2022, the market size of cellulosic ethanol was USD 3,150.00 million.

- What will be the potential market valuation for the cellulosic ethanol industry by 2030?

- In 2030, the market size of cellulosic ethanol will be expected to reach USD 9,539.47 million.

- What are the key factors restraining the growth of the cellulosic ethanol market?

- The lack of infrastructure to produce cellulosic ethanol is restraining the market growth.

- What is the dominating segment in the cellulosic ethanol market by application?

- In 2022, the fuel & fuel additives segment accounted for the highest market share in the overall cellulosic ethanol market.

- Based on current market trends and future predictions, which geographical region is the fastest-growing region in the cellulosic ethanol market?

- Asia Pacific is expected to grow with the highest CAGR in the cellulosic ethanol market.