EV Price Pressure Grows as Government Incentives and Lease Deals Wield Outsized Influence on Consumer Demand-JD Power

|

March 2023

EV Price Pressure Grows as Government Incentives and Lease Deals Wield Outsized Influence on Consumer Demand

Key Findings

-

Improved Affordability and Availability Drive EV Adoption to All-Time High: As of February, EVs account for 8.5% of the total new-vehicle purchase and lease market, a record high, driven largely by significant improvement in affordability and availability.

- Government Incentives and Price Cuts Put Spotlight on Consumer Price Sensitivity: Consumer interest in EVs is increasingly being heavily swayed by price, with a clear correlation emerging between consumer demand and government incentives, lease deals and manufacturer price cuts.

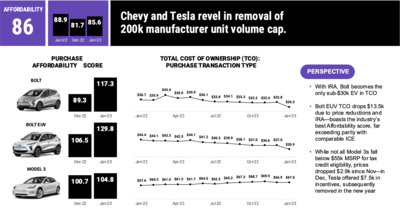

- Era of the Sub-$30,000 EV: A combination of increased availability of lower-priced EVs and the introduction of Inflation Reduction Act has driven the total cost of EV ownership down for many models. The Chevrolet Bolt is leading the way as the first EV with a five-year purchase total cost of ownership of under $30k ($26.2k).

Executive Summary

“EVs are great, but they are too expensive,” has been the common refrain heard across countless consumer surveys, industry growth forecasts and dealer showroom conversations for the past decade. Now, thanks to a steady increase in availability of new models, expanded price mix within existing models and widening eligibility of federal and state incentives, acquisition cost is starting to fade as a hurdle to EV adoption.

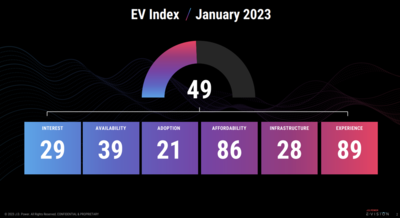

According to the J.D. Power EV Index, a new, advanced analytics tool that tracks the progress to parity of EVs with internal combustion engine (ICE) vehicles in the United States, this steady decline in price mixed with surging availability is setting the stage for a new era of EV price wars. This E-Vision Intelligence Report dives into key data points trending in each monthly EV Index update, along with other data points gathered from J.D. Power studies and pulse surveys, to spotlight emerging trends and important shifts in EV consumer sentiment.

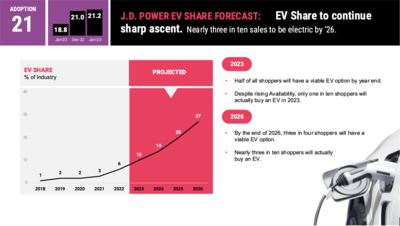

EV Market Share Continues to Rise

Total EV market share has now reached 8.5%, nearly double the share of a year ago. The trend is consistent with steady growth in availability and affordability. The J.D. Power EV Index score for availability climbed sharply to 39.4 (on a 100-point scale) in January 2023 from 35 in December 2022, meaning approximately four-in-ten new vehicle shoppers currently have a viable alternative to ICE vehicles. Overall affordability has also improved by a similar margin, rising to 85.6 in January. Once the overall affordability index reaches 100, EVs will have reached price parity with their internal combustion engine (ICE) counterparts.

At the current trajectory, J.D. Power projects that approximately half of all vehicle shoppers nationwide will have a viable EV option available to them by the end of 2023. By the end of 2026, that number is expected to surpass 75%.

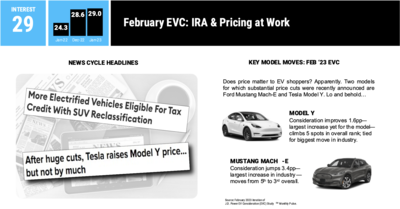

Incentives Highlight Huge Influence of Price on Consumer Behavior

The strong influence of consumer price sensitivity on EV consideration and adoption is on vivid display across several data points in this month’s J.D. Power EV Index. The first evidence can be seen in consumer interest in the Ford Mustang Mach-E and the Tesla Model Y following the reclassification of both vehicles as SUVs, which made them eligible for a $7,500 federal tax credit under the Inflation Reduction Act. Additionally, both manufacturers recently announced significant price cuts on both models.

Consumers responded immediately with a 3.4 percentage point increase in consideration in the Mustang Mach-E and a 1.6 percentage point increase in consideration in the Model Y.

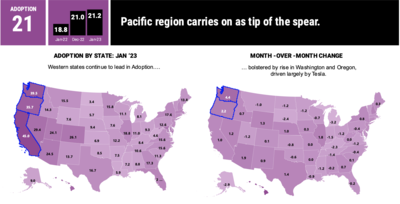

Digging deeper into the influence of finanical incentives on EV adoption, we find a clear correlation between the states with biggest government incentives and consumer EV adoption rates. In California, for example, which currently has an adoption score of 45 (highest in the nation), state tax credits on the purchase or lease of a new EV is $2,000 for cars and $4,500 for trucks, SUVs and vans. Similarly, Oregon, which has an adoption score of 36, currently offers a $2,500 credit on EVs with a retail price at or below $50,000 and a $5,000 credit for EVs that meet certain battery size requirements, making many EV drivers in Oregon eligible for upwards of $7,500 in state rebates. We see similar trends in Colorado, New York and New Jersey where state-level EV incentives have had a significant influence on adoption.

Enter the Sub-$30,000 EV

The culmination of these trends taken together is a steady downward pressure on the price of EVs relative to their ICE counterparts. This is a significant turning point from the early days in the EV marketplace when the few viable models available were priced above $100,000. Now, thanks to federal incentives introduced in the Inflation Reduction Act and growing vehicle supply, prices of many models are trending lower.

The best examples of this trend are the Chevrolet Bolt and Bolt EUV. With incentives, the total cost of ownership of a new Bolt is now just $26,200, down $6,600 from December of last year. Likewise, the Bolt EUV has seen its total cost of ownership fall to $30,900. As this trend continues, we expect to see continued pricing pressure on new models driving increased competition in the EV market.

Methodology

This J.D. Power E-Vision Intelligence Report is based on data and insights from the J.D. Power EV Index and the J.D. Power EV Consideration pulse survey. The J.D. Power EV Index is an analytics tool to benchmark the growing EV market in the United States. It tracks millions of data points aggregated into six categories—interest, availability, adoption, affordability, infrastructure and experience—to evaluate the progress to parity of EVs with ICE vehicles in the U.S. Each month, J.D. Power’s electric vehicle practice will analyze these data points, and others to spotlight emerging trends and important shifts in consumer sentiment that are helping to define the fast-moving EV marketplace.

Find out More

This report was authored by Elizabeth Krear, vice president, electric vehicle practice; Brent Gruber, executive director, electric vehicle practice; Stewart Stropp, executive director, electric vehicle practice; and Kristen Richter, senior manager, electric vehicle practice at J.D. Power. The J.D. Power E-Vision initiative is a company-wide program focused on maximizing J.D. Power industry-leading EV data, analytics, insights and solutions. Please contact us at the numbers below to connect with the authors or to learn more about the underlying research.