EV Makers Face Rising Battery Costs

Special to The Auto Channel

Brownstone Research

The Bleeding Edge

by Jeff Brown

|

We’ve even been able to “back into” related investments in my SPAC-focused investment research in Blank Check Speculator.

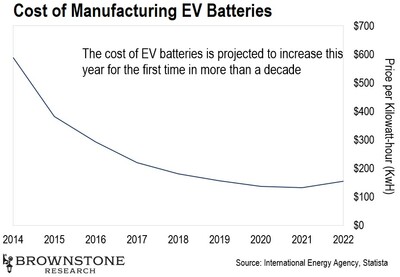

Naturally, my team and I have been researching this sector extensively for years. One of the key enablers of more widespread adoption of EVs over the last decade has been the consistent decline in the cost of manufacturing batteries for electric vehicles.

For the last decade, we’ve seen a consistent and dramatic decline in cost per kilowatt-hour, which has naturally led to less expensive electric vehicles. At least, that was true until this year:

This Monday, the International Energy Agency announced that it expects the cost of EV battery manufacturing will rise by about 15% this year due to the rapidly rising costs of lithium, cobalt, and nickel, which are all commonly used to produce EV batteries.

The price of an EV is tightly linked to the cost of the batteries… It’s the largest single cost of producing an EV.

Driving the cost of batteries down to $100 per kilowatt-hour has long been a goal in the industry. That’s the price point at which EVs are expected to be on par with a comparable internal combustion engine vehicle.

Back in 2010, the cost of batteries was around $1,191 per kilowatt-hour, and by last year that number had dropped to $137. Incredible progress was being made, and the industry was on track to hit just $92 per kilowatt-hour by 2024.

But this year has thrown a wrench into the industry’s targets. It is likely that the average cost per kilowatt-hour will be well above $150 this year. And these developments will likely push out that $100 target by years.

Needless to say, this is the wrong direction and will only increase the sticker price of EVs.

Tesla has an incredible advantage in this regard. It has been proactive and early in securing the raw materials needed for battery manufacturing, and its unique battery chemistry reduces some of the exposure to rising prices. The rest of the industry won’t fare so well in that regard.

The prevailing political narrative around EVs remains strong, however. And I expect that major governments around the world will offer more stimulus to the industry in the form of tax breaks on EV purchases, in an effort to increase the rate of adoption. Of course, the automotive industry will be spending millions lobbying for the same.

Interestingly, these rising costs for batteries mask an even larger challenge for the electric vehicle industry: It simply doesn’t have the ability to make enough batteries to meet the production targets for EVs for this decade.

Legacy automotive companies are guilty of making grand projections of how many millions of EVs they’ll produce a year without having secured the necessary metals required to produce the batteries. In other words, their supply chains are not only not secured, there is no way for them to meet their targets.