Consumers Want The Cars They Want - Look To Technology To Solve The Gasoline Price Inflation Says AutoPacific Report

March 24, 2022, 12:00 GMT

AutoPacific's latest Fuel Price Impact Study reveals over half of consumers are unwilling to change the type of vehicle they drive even with higher fuel prices

Fuel price increases and cries for energy independence have given electrified powertrains a boost in consumer demand.”

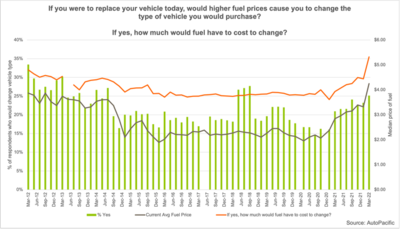

LONG BEACH, CA, UNITED STATES, March 24, 2022 /EINPresswire.com/ -- Noted automotive consulting firm AutoPacific’s latest round of Fuel Price Impact Survey (FPIS) data comes amid alarmingly high fuel prices and continued conflict in Ukraine. The survey, issued bi-monthly to AutoPacific’s proprietary panel of respondents, received responses from over 650 vehicle owners in the United States. The data reveal that over half of consumers (52%) remain unwilling to change the type of vehicle they drive even with higher fuel prices. The 25% who say higher fuel prices would cause them to change the type of vehicle they drive say the price of fuel must be about $1.00 per gallon more than what they’re paying now, or a median price of $5.32 per gallon compared to the current median of $4.23 per gallon. “Historically, and during the long stretch of fairly consistent fuel prices, respondents have said it would take approximately $1.50 more per gallon to cause them to change their vehicle type,” says AutoPacific president and chief analyst Ed Kim. “Despite substantially higher fuel prices recently, the data tell us that consumers are generally unwilling to change the type and size of vehicle they drive.”— Ed Kim

SUV Owners Would Choose Alternative Powertrains Over Downsizing

For those who currently own an SUV or crossover, nearly half (47%) say they would consider a hybrid or plug-in hybrid SUV while 30% would consider an all-electric SUV if fuel prices are as high or higher than now when they’re shopping for their next vehicle. Under those circumstances, only 18% of SUV or crossover owners would consider downsizing to a smaller SUV or crossover, while a scant 7% would consider getting out of their SUV or crossover and into a sedan or other type of passenger car. “Consumers are turning to technology rather than downsizing to solve the problem of rising fuel prices,” says Kim. Even as fuel prices are the highest seen in over a decade, SUV purchase intention continues to rise, with over half of respondents saying they would choose an SUV for their next vehicle and another 13% intending to choose a pickup.

The Conflict in Ukraine Plays a Role in Alternative Powertrain Interest

59% of respondents expect fuel prices to increase in the future, representing the majority of respondents. Of those who expect fuel prices to continue rising, 81% expect that to happen as a direct result of the conflict in Ukraine. “Consumers have far more options now than during previous fuel price spikes with the influx of hybrid, PHEV, and electric vehicles now available for sale and coming in the near future, and it seems that fuel price increases and cries for energy independence have given electrified powertrains a boost in consumer demand,” says Kim.

25% of survey respondents say factors directly related to the conflict in Ukraine make them more likely to consider an EV for their next vehicle. While “charging is cheaper than fueling” remains the top reason why EV intenders would choose an EV (85%), 63% of EV intenders would choose an EV because EVs contribute to energy independence for the U.S. and 52% of EV intenders say the conflicts around the world make them want to reduce their consumption of oil.

About the Fuel Price Impact Study

Since 2005, AutoPacific has conducted a bi-monthly internet survey designed to measure the impact of fuel prices on consumers’ vehicle purchase decisions and driving behavior. The Fuel Price Impact Study puts years of trend data to work to understand how consumers react to fluctuating fuel prices and how the impact has changed over time.

About AutoPacific

AutoPacific is a future-oriented automotive marketing research and product-consulting firm providing clients with industry intelligence and sales forecasting. The firm, founded in 1986, also conducts extensive proprietary research and consulting for auto manufacturers, distributors, marketers, and suppliers worldwide. The company is headquartered in Long Beach, California with affiliate offices in Michigan, Wisconsin, and the Carolinas. Additional information can be found at http://www.autopacific.com.