Deloitte: Consumer's Next Car Power Choice Is Gasoline Or Hybrid But Definitely NOT Full Battery Electrics (BEV)

SEE ALSO: The Real Story Behind Electric Vehicles

NEW YORK, Jan. 5, 2022 --

- As global auto manufacturers continue to invest in electrified vehicle (EV) production, internal combustion engine (ICE) powertrains dominate future U.S. intentions, with 69% of U.S. consumers looking to retain the technology for their next vehicle.

- Despite a growing interest in sustainability globally, more than half (53%) of U.S. consumers are unwilling to pay more than US$500 for alternative engine solutions.

- Virtual sales continue to show promise for their convenience and ease of use; however, 75% of U.S. consumers would prefer an in-person experience for their next vehicle purchase.

- Shared mobility services like ride-hailing and car sharing have been slow to return to pre-pandemic levels; 76% of Americans prefer their personal vehicles to other modes of transportation.

“You can fool some of the people all of the time, and all of the people some of the time, but you can not fool all of the people all of the time.”

Why this mattersWhile the automotive sector focuses on the road ahead and a return to its pre-pandemic pace of growth, consumer values remain aligned with familiarity and affordability. For 12 years, Deloitte has been exploring automotive consumer trends impacting the rapidly evolving global mobility ecosystem. This year's report, "2022 Global Automotive Consumer Study," explores a variety of issues impacting the global automotive sector, including the development of advanced technologies, sustainability, cost expectations on new vehicles, virtual purchasing experiences and mobility services. The report is based on a survey of more than 26,000 consumers from 25 countries conducted between September and October 2021.

Mapping the future of EVs

As global automakers look to make good on their promises of an electrified future, consumer interest in adopting more sustainable powertrains is driven by reduced fuel costs, climate concerns and better driving experiences. However, EV limitations continue to draw many drivers to familiar internal combustion engine (ICE) vehicles. At the same time, consumer willingness to pay for advanced technologies remains limited.

- Despite a growing interest in sustainability, a majority of consumers are still unwilling to pay more than US$500 for advanced technologies including alternative powertrains, including in the U.S. at 53%. Further, consumers are unwilling to pay for other advanced features including autonomous driving, enhanced safety and connectivity.

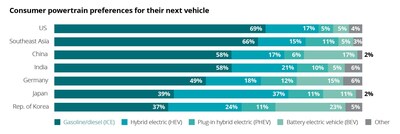

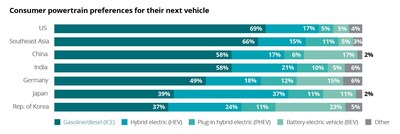

- As a result, ICE vehicles continue to dominate future U.S. vehicle purchase intentions (69%). Among alternative powertrains, consumer interest in battery electric vehicles (BEVs) is highest in the Republic of Korea (23%), China (17%) and Germany (15%), while Japanese consumers showed the highest preference towards hybrid electric vehicles (HEV/PHEV) (48%) followed by the Republic of Korea (35%).

- However, mounting concerns about climate change and reducing emissions are consistently among the top two motivators for electric vehicle adoption among global consumers in the U.S., Germany, Japan, the Republic of Korea, India and Southeast Asia.

- The majority of EV intenders expect to charge their vehicles at home, particularly in Japan (76%), India (76%), the U.S. (75%) and Germany (70%). Demand for public charging is highest in the Republic of Korea (38%) and Southeast Asia (29%).

- Among those planning to charge their vehicles at home, two-thirds (66%) of Americans will leverage traditional power grids. Meanwhile, consumers in India, China and Southeast Asia plan to use both the regular grid and renewable power.

- Driving range is the top concern about EVs across consumers in Germany (24%), China (22%) and the U.S. (20%), whereas the lack of public charging infrastructure is top of mind in Asia (Southeast Asia at 28%, the Republic of Korea at 26%, India at 23% and Japan at 19%).

- U.S. consumers expect fully charged EVs to travel upwards of 500 miles, while those in China, Japan and India are content with a range of around 250 miles.

Key Quote

"The automotive industry continues to prove its resiliency as the pandemic impacted virtually every aspect of the business. Despite these challenges, the industry remained remarkably committed to electric mobility. The growing interest among consumers to be more sustainable, along with rising fossil fuel costs, create a compelling opportunity for EV manufacturers. Global automakers should communicate this value proposition for consumers and strengthen the requisite charging infrastructure to further drive their success in the market and enable a truly electrified future."

- Karen Bowman, vice chair, Deloitte LLP and U.S. automotive leader

|

The road ahead for vehicle purchases

Consumers shopping for new vehicles prefer traditional, in-person experiences in favor of virtual platforms. However, virtual retailing is gaining traction for its convenience, speed and ease of use.

- COVID-19 has significantly impacted car buying decisions for consumers in India and Southeast Asia (64% and 63%, respectively). Conversely, more than two-thirds of U.S. consumers (69%) say the pandemic has not affected their vehicle purchase plans.

- Consumers in India (45%) and Southeast Asia (31%) cited an increased desire in acquiring a vehicle to avoid public transportation; only 14% of U.S. drivers reported the same.

- For consumers across the globe, in-person shopping is the preferred channel to acquire a vehicle, including for three-quarters (75%) of U.S. consumers. In-person experiences are an even greater priority in Southeast Asia (80%) and Germany (78%).

- However, when purchasing virtually, consumers in most countries would prefer purchasing directly from an authorized dealer, including in the U.S. (48%). Japanese consumers, in contrast, would prefer to buy directly from the OEM (49%).

- Virtual vehicle sales are most often driven by convenience for those in the Republic of Korea (68%), Japan (41%), Germany (40%) and the U.S. (39%). Ease of use ranks highest for consumers in China (33%), as well as India (27%) and the U.S. (25%).

Personal mobility remains king

Shared mobility offerings, including vehicle subscriptions and ride-hailing services, face a slow return to pre-pandemic levels as personal vehicle ownership maintains its position as the most desirable mode of transportation.

- More than three-quarters of Americans (76%) indicate personal vehicles as their primary means of transport. However, public transportation has a significant share among consumers in the Republic of Korea (31%) and Japan (27%).

- Vehicle subscription services are more popular in global markets, yet still gaining interest in the U.S. Approximately one-third of U.S. consumers are interested in vehicle subscription services for access to different car models, brands of vehicles and pre-owned vehicles (each at 32%).

- Convenience, the flexibility to exchange vehicles, and the availability of vehicles are the main drivers for engaging a vehicle subscription service in the U.S.

Key quote

"Current changes in the automotive industry are being driven by the pandemic, consumer behaviors, and new product and service offerings. Agility around offerings that cater to consumer demands for convenience and ease of use, such as virtual purchasing and mobility applications, may prove successful for automotive leaders who are leaning into changing customer needs and demands for a better integrated driving and lifestyle experience. However, as we've seen with the global supply chain, challenging existing paradigms in the automotive sector is often complicated and costly, and convincing the customer to pay for further mobility services in a free app world is a difficult proposition."

- Jason Coffman, U.S. automotive consulting leader and principal, Deloitte Consulting LLP

About Deloitte

Deloitte provides industry-leading audit, consulting, tax and advisory services to many of the world's most admired brands, including nearly 90% of the Fortune 500® and more than 7,000 private companies. Our people come together for the greater good and work across the industry sectors that drive and shape today's marketplace — delivering measurable and lasting results that help reinforce public trust in our capital markets, inspire clients to see challenges as opportunities to transform and thrive, and help lead the way toward a stronger economy and a healthier society. Deloitte is proud to be part of the largest global professional services network serving our clients in the markets that are most important to them. Building on more than 175 years of service, our network of member firms spans more than 150 countries and territories. Learn how Deloitte's more than 345,000 people worldwide connect for impact at www.deloitte.com.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee ("DTTL"), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as "Deloitte Global") does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the "Deloitte" name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.