Lendingtree Guest Post: Where Borrowers Are Taking Out the Longest Auto Loans

Written by: Kamaron McNair

Edited by: Dan Shepard

Pearly Huang

Updated on: November 1st, 2021

As the prices of new and used cars skyrocket, so, too, are average auto loan lengths. Since long-term auto loans can mean lower monthly costs, car buyers may favor or need the extra time to afford vehicle purchases.

But longer payment terms can cost buyers more money because of the accrued interest. Researchers look at loans closed on the LendingTree platform over the last three years to see where people take out longer car loans — and how average term lengths have changed.

Though auto loans for new cars tend to have longer terms, this data looks mostly at used cars based on the typical closed loan through the LendingTree platform.

Key findings

- Auto loans originated through the LendingTree platform over the past three years have an average term of 62.9 months. Florida car buyers take out the longest average car loans at the state level — 64.7 months, tied with Arizona — and metro level — four Sunshine State metros land in the top 10, led by No. 1 Jacksonville (66.4 months).

- Some of the highest-earning metros have the shortest average auto loan terms. San Francisco residents take out the shortest average loans at 60.2 months. New York City and Milwaukee tie for next to last at 61 months, on average.

- Hartford, Conn., has the highest rate of borrowers taking on extremely long loans — more than six years — at 14.7%. 13.3% of Charleston, S.C., buyers take on extra-long loans, while 12%, 11.7% and 11.7% of Phoenix, Tampa, Fla., and Atlanta residents, respectively, originate auto loans of more than six years.

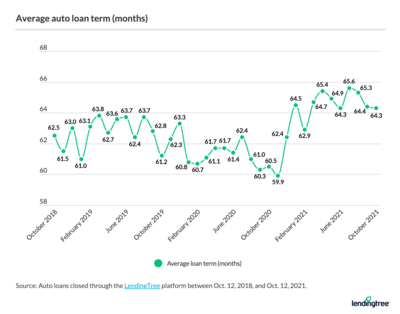

- Average auto loan lengths dipped in 2020 before increasing significantly throughout 2021. Term lengths hit their lowest point in the past three years in November 2020 — 59.9 months, on average — and reached their three-year peak of 65.6, on average, in July 2021.

- The most common loan lengths nationally are 72 months (36.5%), 60 months (34.8%) and less than 60 months (19.2%). Just 7.8% of borrowers take on longer loans than six years.

- Tesla buyers take on the longest loan terms, at an average of 67.1 months. Buyers of Ram trucks follow at 66.3 months, on average, while Mini and Lexus buyers take out the shortest loans, at an average of 59.7 and 60.4 months, respectively.