The Current Car Shortage Led To Car Prices To Soar

|

Car Models With the Highest & Lowest Markup for August

The current car shortage has led to car prices soaring, but which models have been most affected?FindTheBestCarPrice has revealed the true impact of this crisis, analyzing August’s figures and finding the car models that have had the highest - and the lowest markups in price.

The model that has faced the biggest increase in price in August 2021 is the RAM 1500 Tradesman.

The model’s manufacturer’s suggested retail price (MSRP) is $32,245, but the current market price is $52,092. That’s 162% of the MSRP, or $19,847 over the suggested retail price.

Other models affected include the Ford F-150 XL, currently being sold on the market at an extra cost of $16,746 or 158% of its MSRP.

However they also found the model that has stayed closest to its original MSRP.

The Buick Encore GX Preferred is just 92% of the MSRP, or $2,111 below the suggested retail price.

This was followed by the RAM 1500 Limited. The vehicle’s MSRP is $56,050, however the current price is just 93% of the suggested retail price, or $3,957 below. As a general rule of thumb, 3-8% over the invoice price is a fair offer for a new car.

The experts behind the analysis advised on whether or not to wait on buying a new car whilst this pricing crisis continues: “Waiting would be a good option if the dealer markups were simply a result of one predictable factor.

“However, it is apparent that no one reason is to blame for today’s vehicle price markups. The unusual market disruption is a combination of many effects, all of which are in one way or another COVID-related.

“However, as the 2021 model year ends and new 2022 model year vehicles arrive, manufacturers have a chance to raise prices, and we suspect many will do so.

“This makes waiting for a game that may never have an ending.”

To help you avoid paying more than you should, find FindTheBestCarPrice’s full report here.

John Goreham is a life-long car nut and recovering engineer. John’s focus areas are technology, safety, and green vehicles. In the 1990s, he was part of an academic team that built a solar-electric vehicle from scratch. His was the role of the battery thermal control designer. After earning his engineering degree, John also completed a marketing program at Northeastern University. For 20 years, he applied his engineering and sales talents in the worlds of semiconductor manufacturing, biopharmaceutical production, and automotive electronics supply chain. Always a writer, John has published numerous articles in technical journals such as Chemical Processing Magazine. In 2008 he retired from that career and dedicated himself to chasing his dream of being an auto writer. In addition to online publications such as Car Talk, John’s work has appeared in print in dozens of American newspapers, and he provides reviews to many vehicle shopping sites.

The recent COVID pandemic coupled with work stoppages and a never-ending boom-bust cycle for semiconductors has wreaked havoc on the U.S. auto market.

The result is that a shortage of vehicles is driving the value of used cars up, and new vehicle prices are being marked up dramatically by dealers.

The most commonly-used phrase for the dealer markups is a vehicle “Market Adjustment.” Some people are paying these higher prices. Others are opting not to and are waiting out the crisis.

Table of Contents [hide]

- Car Models With the Highest Markup for August

- Car Models With the Lowest Markup for August

- What Is the Markup on New Cars?

- Why Pay More Than MSRP?

- Why Do Vehicles Have a High Markup?

- Highest Markup Truck

- Highest Markup SUV

- Highest Markup Sedan

- Lowest Markup Truck

- Lowest Markup SUV

- Lowest Markup Sedan

- Final Words on Market Adjustment

- Best Car Deals by Category

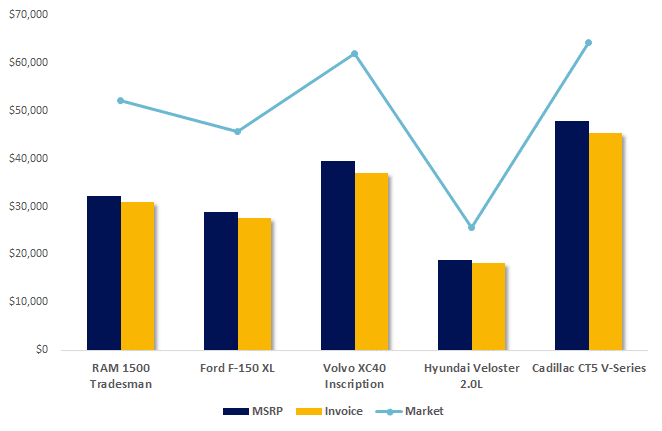

Car Models With the Highest Markup for August

When popular models overlap with limited production ability, the market adjustments are the most extreme.

#1 Highest Markup: 2021 RAM 1500 Tradesman

- MSRP: $32,245

- Market Price: $52,092

- Invoice Price: $30,899

- Markup Amount & Percentage: $19,847 or 162% of MSRP

Compare RAM 1500 prices and trims here >>

#2 Highest Markup: Ford F-150 XL

- MSRP: $28,940

- Market Price: $45,686

- Invoice Price: $27,638

- Markup Amount & Percentage: $16,746 or 158% of MSRP

Compare Ford F-150 prices and trims here >>

#3 Highest Markup: Volvo XC40 Inscription

- MSRP: $39,450

- Market Price: $62,073

- Invoice Price: $37,083

- Markup Amount & Percentage: $22,623 or 157% of MSRP

Compare Volvo XC40 prices and trims here >>

#4 Highest Markup: Hyundai Veloster 2.0L

MSRP: $18,900

MSRP: $18,900- Market Price: $25,666

- Invoice Price: $18,271

- Markup Amount & Percentage: $6,766 or 136% of MSRP

Compare Hyundai Veloster prices and trims here >>

#5 Highest Markup: Cadillac CT5 V-Series

- MSRP: $47,795

- Market Price: $64,333

- Invoice Price: $45,405

- Markup Amount & Percentage: $16,538 or 135% of MSRP

Compare Cadillac CT5 prices and trims here >>

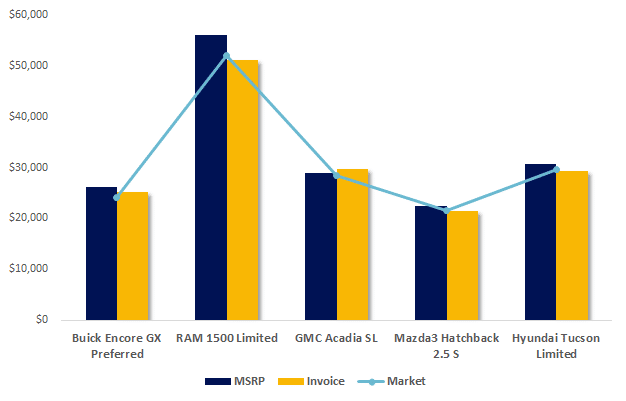

Car Models With the Lowest Markup for August

Not every model is seeing five-figure markups. In many cases, the markups are more reasonable.

#1 Lowest Markup: Buick Encore GX Preferred

- MSRP: $26,200

- Market Price: $24,088

- Invoice Price: $25,257

- Markup Amount & Percentage: $2,111 or 92% of MSRP

Compare Buick Encore GX prices and trims here >>

#2 Lowest Markup: RAM 1500 Limited

- MSRP: $56,050

- Market Price: $52,092

- Invoice Price: $51,246

- Markup Amount & Percentage: $3,957 or 93% of MSRP

Compare RAM 1500 prices and trims here >>

#3 Lowest Markup: GMC Acadia SL

- MSRP: $29,800

- Market Price: $28,384

- Invoice Price: $29,770

- Markup Amount & Percentage: $1,416 or 95% of MSRP

Compare GMC Acadia prices and trims here >>

#4 Lowest Markup: Mazda3 Hatchback 2.5S

- MSRP: $22,500

- Market Price: $21,553

- Invoice Price: $21,520

- Markup Amount & Percentage: $946 or 96% of MSRP

Compare Mazda3 Hatchback prices and trims here >>

#5 Lowest Markup: Hyundai Tucson Limited

- MSRP: $30,800

- Market Price: $29,676

- Invoice Price: $29,274

- Markup Amount & Percentage: $1,123 or 96% of MSRP

Compare Hyundai Tucson prices and trims here >>

What Is the Markup on New Cars?

The markup on new cars is a way for dealers and manufacturers to make more money on each vehicle they sell during this period of unusually constricted supply. Dealers have relatively fewer vehicles to sell to a market that was in some sense shut down for a period of time.

That built-up demand of buyers who did not purchase on their normal schedule coupled with the shortages of semiconductors and batteries is putting dealers in the catbird seat when it comes to pricing.

It is important to step back and realize that the “free market” we employ in America means that scarce goods can be priced higher. The converse is also true. Chevy dealers were discounting new Bolts by nearly $20,000 as recently as March of this year.

What Is The Average Dealer Markup?

The average dealer markup is hard to determine since it's based on local pricing, demand, and inventory. However, it’s worth noting that the average transaction price has gone up in the past couple of years. According to COX Automotive, the average transaction price was $1,764 below MSRP in 2020 versus $2,286 below MSRP in 2019.

In some cases, popular vehicles like the Toyota RAV4 Prime have a markup of $10,000, $20,000, or in rare cases, $30,000 over the manufacturer’s suggested retail price.

Couple that with the inventory shortage due to the COVID pandemic, and it comes as no surprise that the average dealer markup will go up as well.

On average, 3-8% over the invoice price is a fair offer for a new car. However, you should check the average market prices to see what others have been paying for your desired vehicle.

Why Pay More Than MSRP?

MSRP is just a starting point for vehicle pricing. Prior to COVID, markups on rare or very popular models were not unheard of.

People purchased these desirable vehicles at above the manufacturer’s suggested retail price because they felt the vehicle was worth the markup. The same holds true today.

Why Do Vehicles Have a High Markup?

Looking more deeply into the market situation, there is a bit more going on than just “shortages mean higher prices". The U.S. economy is shifting in a way it hasn’t before.

Prices for many goods and services are rapidly escalating. Anyone who has priced a home renovation this year knows this to be true. The value of existing homes has also gone up dramatically over the past year to 18 months. In addition, gasoline has gone up by more than 40% in many parts of America in the past year.

Call it inflation, or use another term, the fact is that the cost of many things is headed up rapidly today.

Should I Wait?

Waiting would be a good option if the dealer markups were simply a result of one predictable factor. However, as the 2021 model year ends and new 2022 model year vehicles arrive, manufacturers have a chance to raise prices, and we suspect many will do so. This makes waiting for a game that may never have an ending.

Opting for a used vehicle is a hard choice to make as well. With many models selling for prices higher than the cost of that model new, buying a used vehicle in this climate is a hard pill to swallow.

Waiting for six months if you still have a viable vehicle is a move that seems prudent. If you can repair or maintain your vehicle to get through the coming winter, the spring may be a better market for both new and used vehicles. This assumes that COVID doesn’t push us out of our manufacturing jobs again.

Many articles you may find on the subject of today’s vehicle prices try to oversimplify the situation. “It’s the semiconductor shortage” is a common theme. “It’s because auto factories were shut down”, is another. “It’s because people didn’t shop during COVID,” yet another common refrain. Some people even try to pin the situation on one politician or one party.

Many articles you may find on the subject of today’s vehicle prices try to oversimplify the situation. “It’s the semiconductor shortage” is a common theme. “It’s because auto factories were shut down”, is another. “It’s because people didn’t shop during COVID,” yet another common refrain. Some people even try to pin the situation on one politician or one party.