J.D. Power 2020 U.S. Dealer Financing Satisfaction Study (Graphic: Business Wire)

J.D. Power 2020 U.S. Dealer Financing Satisfaction Study (Graphic: Business Wire)

-

Full Size

-

Small

-

Preview

-

Thumbnail

-

J.D. Power 2020 U.S. Dealer Financing Satisfaction Study (Graphic: Business Wire)

-

Full Size

-

Small

-

Preview

-

Thumbnail

-

J.D. Power 2020 U.S. Dealer Financing Satisfaction Study (Graphic: Business Wire)

-

Full Size

-

Small

-

Preview

-

Thumbnail

-

J.D. Power 2020 U.S. Dealer Financing Satisfaction Study (Graphic: Business Wire)

-

Full Size

-

Small

-

Preview

-

Thumbnail

-

J.D. Power 2020 U.S. Dealer Financing Satisfaction Study (Graphic: Business Wire)

-

Full Size

-

Small

-

Preview

-

Thumbnail

-

-

Full Size

-

Small

-

Preview

-

Thumbnail

-

TROY, Mich.--(BUSINESS WIRE)--Disruption has been the name of the game in the automotive finance industry as the COVID-19 pandemic has simultaneously strained day-to-day operations and pushed more transactions than ever to digital. According to the J.D. Power 2020 U.S. Dealer Financing Satisfaction Study,SM released today, these changes—many of which dealers expect to be long-term—are forcing lenders to evolve quickly in an increasingly digital environment.

“The pandemic has severely disrupted dealer-lender communication, with many dealers reporting that lenders were delayed or not available when they needed them, or not able to assist in a timely manner,” said Patrick Roosenberg, director of automotive finance intelligence at J.D. Power. “While the effect of the pandemic has pushed more sales to digital channels, 55% of dealers are saying they expect at least one in five of their sales to be digital in the next year. With lenders’ sales reps forgoing on-site dealer visits and the credit staff and funders working remotely, the need for consistent and reliable communication is paramount to dealer satisfaction. Lenders will need to step up their efforts to deliver high levels of service to help facilitate sales, whether those transactions are happening virtually or in the dealership. Knowledgeable, helpful and available sales reps, credit analysts and funders can help drive incremental business.”

Study Rankings

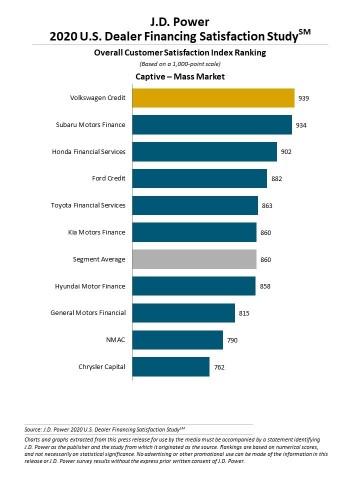

Captive—Mass Market Segment

Volkswagen Credit ranks highest in overall dealer satisfaction with a score of 939 (on a 1,000-point scale), followed by Subaru Motors Finance (934) and Honda Financial Services (902).

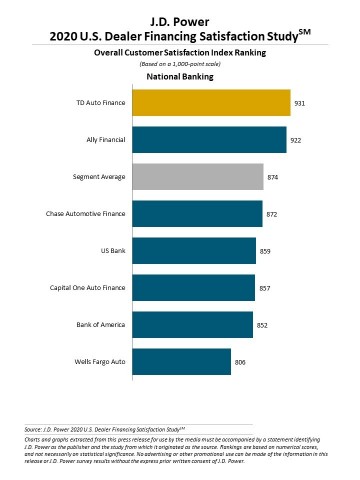

National Banking

TD Auto Finance ranks highest in overall dealer satisfaction with a score of 931, followed by Ally Financial (922) and Chase Automotive Finance (872).

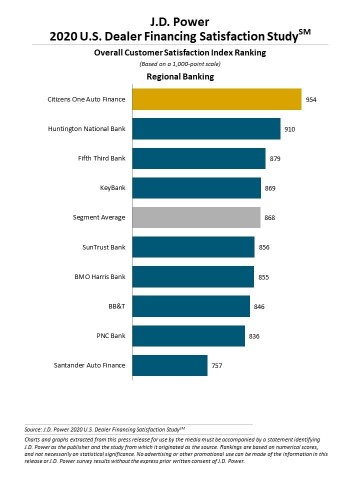

Regional Banking

Citizens One Auto Finance ranks highest in overall dealer satisfaction with a score of 954, followed by Huntington National Bank (910) and Fifth Third Bank (879).

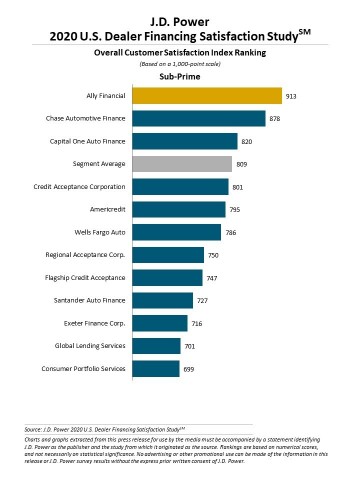

Sub-Prime

Ally Financial ranks highest in overall dealer satisfaction with a score of 913, followed by Chase Automotive Finance (878) and Capital One Auto Finance (820).

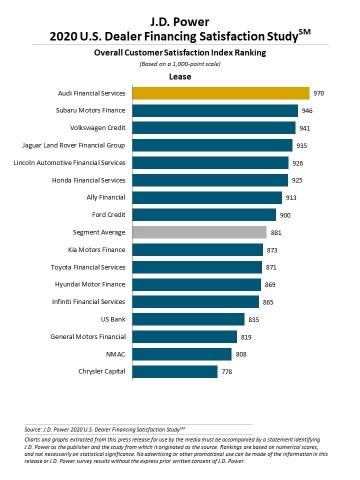

Lease

Audi Financial Services ranks highest in overall dealer satisfaction with a score of 970, followed by Subaru Motors Finance (946) and Volkswagen Credit (941).

The 2020 U.S. Dealer Financing Satisfaction Study is based on responses from 3,960 auto dealer financial professionals. The study, which was fielded in August-September 2020, measures auto dealer satisfaction in six segments of lenders: captive luxury–prime;1 captive mass market–prime; lease; non-captive national–prime; non-captive regional–prime; and non-captive sub-prime.

For more information about the J.D. Power U.S. Dealer Financing Satisfaction Study, visit https://www.jdpower.com/business/resource/us-dealer-financing-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2020170.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info.

1 The captive luxury segment did not meet requirements to be award eligible.

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com