DALLAS- DIMONT, a Dallas-based provider of insurance claims adjusting and collateral loss mitigation services to the residential mortgage and auto lending industries, had Denis Brosnan, president and CEO, take part in a panel on auto fraud and Steven Garcia, director of auto claims, participate in a discussion on risk management at the National Auto Finance Association’s 22nd Annual Non-Prime Auto Financing conference, which occurred on May 30, 2018-June 1 in Fort Worth, Texas.

During the conference’s Fraud Friday on June 1, Brosnan and four other industry experts participated in the Portfolio Fraud Prevention panel and offered perspective on post-funding fraud that can be committed by borrowers, dealers, repair shops, title services and others. Approximately 75 people attended the session.

Garcia’s Collection Analytics panel took place on May 31 as part of the event’s Risk Management track and involved three other executives who shared their views on best practices associated with using new technology to increase collection results. Approximately 125 people attended.

“There was a focus on boosting profitability and the use of technology throughout many of the panels at the Non-Prime Automotive Financing conference,” said Brosnan. “The conference was valuable because it enabled attendees to clearly see the link between profitability and technology and offered a vision on how the auto industry can take next steps to help their own organizations advance to the next level.”

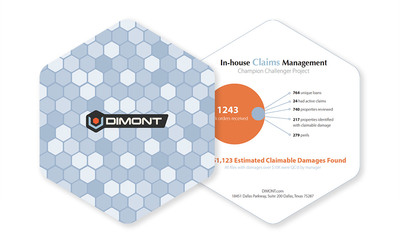

About DIMONT

Founded in 1996, Dallas-based DIMONT is one of the largest providers of insurance claims and collateral loss mitigation services to the residential mortgage and auto lending industries in the United States. Additional information is available at www.dimont.com.