Wholesale Used Car Prices Continue To Come Down

New vehicle sales for full year 2017 were down 2% compared to 2016. At 17.1 million units for the year, annual new vehicle sales slipped for the first time in seven years.

Combined rental, commercial, and government purchases of new vehicles were down 5% year-over-year in December, led by declines in commercial (-6%) and rental (-5%) fleet channels. Overall fleet sales were down 8% for 2017 versus 2016.

New vehicle inventories remained below 4 million units, as December stock came in at the lowest level in 2017 and one of the lowest monthly levels in the past 24 months.

Used sales increase in December. According to Cox Automotive estimates, used car sales increased by 4% year-over-year in December. The December used SAAR increased to 38.9 million units. At 39 million units for 2017, used vehicle sales grew 1% versus 2016.

Rental risk pricing also weakens. The average price for rental risk units sold at auction in December was up 0.3% year-over-year. Rental risk prices were down 2% compared to November. Average mileage for rental risk units in December (at 49,700 miles) was 15% above a year ago.

Economy showing strong momentum. The final reading on third-quarter real GDP growth came in at 3.2%. A strong stock market, high consumer confidence, and low unemployment are major factors for continued economic growth in 2018. The tax reform’s positive impact on most households’ take-home pay should reinforce consumer spending and help offset the impact of higher interest rates on vehicle loans. Both used and new vehicle sales should end up incrementally higher in 2018 relative to what they would have been without tax reform.

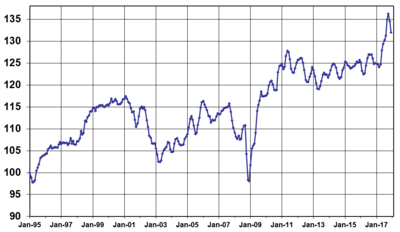

Expect pricing weakness for next few months. Depreciation has accelerated for most vehicles to catch up with the abnormal pricing performance in September and October. This will likely continue through January as the Manheim Index should trend closer to its value prior to the hurricanes. As we look ahead in 2018, we will likely miss the normal “bounce” in used vehicle prices in March as tax refunds will again be delayed as part of the IRS effort to combat identity fraud. Prices should be on firmer footing by April as retail demand kicks into gear.