Tesla 3: Is The Hype Selling Cars?

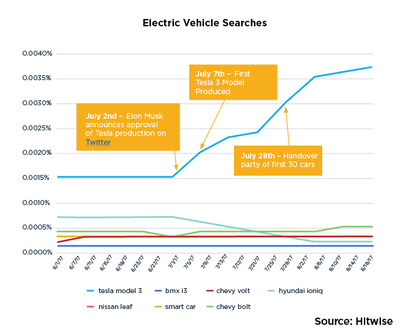

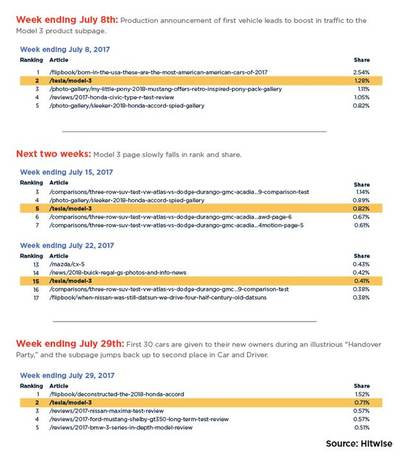

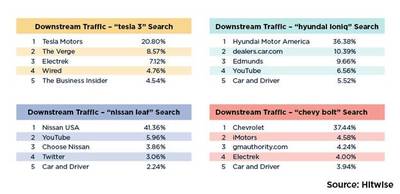

A recent study of search traffic to automotive websites by Hitwise shows that while Tesla has captured lots of public attention, other EV brands such as the Hyundai Ioniq, Nissan Leaf and Chevy Bolt pull a higher share of search traffic to their own websites, as well as comparison sites like Edmunds, iMotors or Car and Driver, suggesting more potent signs of purchase intent. If you want to create quotes from any of the report, please attribute to: Rochelle Bailis, Global Director of Content, Hitwise While the rest of the auto industry struggles, electric and hybrid vehicles have taken off, with fully electric cars increasing sales by a whopping 134% year-on-year. Nearly every auto maker is playing catch-up and producing its own EV line, but currently Tesla dominates the market. They account for approximately 4 out of 10 electric vehicle sales in the US and recently eclipsed GM and Ford in market valuation, making Telsa the most valuable American car company in the world. What is the secret behind their momentum? It constitutes a unique blend of innovation, branding, and PR strategy, spearheaded by their prominent CEO, Elon Musk. Since it was publicly announced in 2016, the Model 3 has been showered with publicity. This year, Tesla's roll-out of the first several car models was expertly crafted to build coverage, interest and anticipation over the entire month of July. As searches for Tesla soared, they appeared to pull search share away from other EV players like the Hyundai Ioniq. Searches for top electric vehicles pulled using Hitwise Intelligence from 6/3/2017 - 8/18/2017. These peaks of interest in the Model 3 over the month of July were mirrored on several auto industry websites, like Car and Driver. Below we break down a play-by-play timeline of the Model 3 subpage rank on caranddriver.com over the course of July. Article Ranking <http://www.carandriver.com/tesla/model-3> www.carandriver.com/tesla/model-3 First Model 3 Produced: Production announcement of first vehicle leads to boost in traffic to the Model 3 product subpage on Car and Driver. Handover Party: First 30 cars are given to their new owners during an illustrious "Handover Party," and the subpage jumps back up to second place in Car and Driver. Next two weeks: Relatively quiet on the PR front. Model 3 page slowly falls in rank and share. Sub-domain traffic share for caranddriver.com pulled using Hitwise Article Tracker, over 4 individual weeks ending 7/29/17. All this hype is great, but does it translate to widespread purchase intent for the Model 3? Perhaps not. During the week when the first Model 3 vehicles were released, searches for "tesla model 3" drove a lot of traffic to technology publications like the Verge and Wired, and less relative share to its own website compared to other electric vehicle brands. Meanwhile, other EV brands pull a higher share of search traffic to their own websites, as well as comparison sites like Edmunds, iMotors or Car and Driver, suggesting more potent signs of purchase intent. Tesla has captured public attention, but the burden still remains to convert enough interested researchers to make up for the steep financial investment it's made in the Model 3. Downstream search clicks (website traffic) from search terms "tesla model 3" "hyundai ioniq" "nissan leaf" and "chevy bolt" pulled over the week ending 7/29/17. Bottom Line: Leverage the power of anticipation and plant seeds of desire in future customers: Like Tesla, auto brands have the opportunity to stoke early desire amongst future customers before they are ready to buy; use an overlap analysis to identify segments that are unique to your brand, ideally those who are young and aspirational. This can be a particularly powerful strategy for electric vehicles, where it's crucial to fight for mindshare early. <http://www.hitwise.com/> Hitwise, a division of Connexity, is a leading audience insights tool for hundreds of companies worldwide. Hitwise insights are derived from an online behavioral panel of over 8 million individuals tracked on over 20 million websites across 500 million monthly search queries and from over 100 million in-market shoppers. Qualitative consumer insights are added to the mix based on up to 60,000 attributes then made addressable across 650 million devices. Hitwise provides marketers in all industries with unparalleled insights paired with powerful programmatic technology. As a result, marketers can identify their best audience segments and then activate them, all in one place. George H. Simpson George H. Simpson Communications 203.521.0352 george@georgesimpson.com <mailto:george@georgesimpson.com> www.georgesimpson.com <http://www.georgesimpson.com>