(Graphic: Business Wire)

(Graphic: Business Wire)

-

Full Size

-

Small

-

Preview

-

Thumbnail

-

-

Small

-

Preview

-

Thumbnail

-

AUSTIN, Texas—When it comes to the cost of auto insurance, mileage matters, and, to most, that’s no surprise. But many drivers may be shocked by how much their annual miles—and location—can cause their rate to rise.

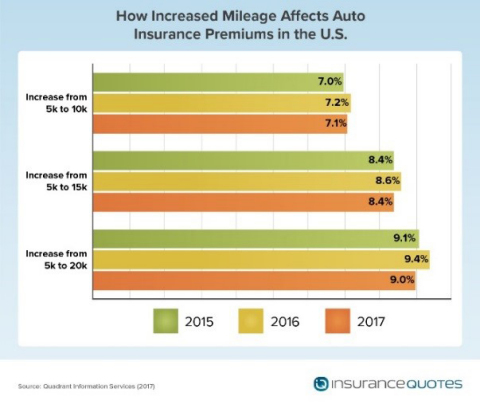

For the third year in a row, insuranceQuotes.com examined the average economic impact annual miles driven has on the cost of auto insurance. Among the study’s findings, it was revealed that drivers who increase their annual miles from 5,000 to 20,000 see an average rate increase of 9%.

“When determining rates, auto insurers typically use mileage as a major factor. But the amount varies considerably depending on where you live. Consumers who live in states with the biggest hikes have more opportunity to save by driving less,” said Laura Adams, senior insurance analyst at insuranceQuotes. “In California, increasing your mileage from 5,000 to 20,000 causes a premium increase over 25%.”

Below are the top five states where drivers see the highest rate increase when annual mileage increases from 5,000 to 20,000 miles:

1. California – 25.66%

2. Alabama – 9.79%

3. Virginia – 9.21%

4. Massachusetts – 9.13%

5. Washington, D.C. – 9.07%

Meanwhile, below are the top five states where drivers see the lowest rate increases:

1. North Carolina – 0%

2. Rhode Island – 1.07%

3. Georgia – 2.53%

4. Texas – 2.82%

5. Oregon – 3.06%

“When your driving habits change for any reason—such as working from home, having a different commute, or retiring, let your insurer know,” said Adams. “Regardless of the financial impact, drivers should always be honest about their mileage, otherwise you risk having a claim denied.”

The full report—which includes full state-by-state data, as well as important analysis and saving tips—is available at https://www.insurancequotes.com/auto/auto-mileage-affects-insurance-rates-8152017.

Methodology:

insuranceQuotes.com commissioned Quadrant Information Services to measure the impacts of mileage on car insurance premiums using data from the largest carriers (representing 60-70 percent of market share) in each U.S. state and the District of Columbia. Averages are based on a 45-year-old married female driving a 2015 vehicle, employed, with a B.A., excellent credit, no lapse in coverage, with the following coverage limits: $100,000 bodily injury, $300,000 property damage, $100,000 UI/UIM, $10,000 PIP and $500 deductibles for comprehensive and collision.

About insuranceQuotes:

insuranceQuotes gives consumers a free, easy way to shop and compare insurance quotes online for auto, home, health, life and business. Follow on Facebook, Twitter, and Google Plus.

Contacts

For insuranceQuotes:

Gabrielle Wesseldyk, 212-255-0945

gabrielle@rosengrouppr.com