Tesla New Model 3 Will Benefit Korea's LG Chem and Samsung SDI

EDITORS NOTE: Excerpt from WSJ Editorial; "Voters Should Be Mad at Electric Cars": When averaged over Tesla’s total U.S. sales, the combined subsidies amount to $20,000 per car, and in California upward of $45,000. And for what purpose? Electricity, in America, is largely produced from fossil fuels. If the electric system were somehow converted to renewables, then it wouldn’t matter how we powered our cars, because passenger cars account for less than 8% of global greenhouse emissions.

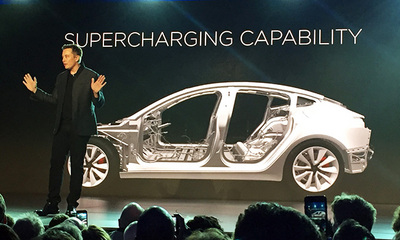

Seoul April 4, 2016; Lee Min-hyung writing for the Korea Times reported that Tesla Motor's new compact electric vehicle (EV) is expected to help LG Chem and Samsung SDI boost their profits as the U.S. automaker eyes the budget EV market with the Model 3.

A leading market research firm said Sunday that the Model 3 would keep Korean battery manufacturing lines busy as Tesla's cheapest-ever EV was expected to become a key growth driver to rev up the infant EV industry.

"We have a high conviction that batteries are on the cusp of dramatic growth as costs fall to levels that make EVs not just cool, but also economical, and energy storage for both utilities and renewable starts to make sense," Mark Newman of Bernstein Research said in a report, analyzing the effects of the Model 3.

Vehicle cost has remained one of the biggest stumbling blocks standing in the way of EVs, despite their eco-friendly features. But the price-competitive model sells at $35,000 in the United States, which the analyst says will propel EVs to the "tipping point of mass adoption."

Given that batteries are the key component of EVs, the improved lithium-ion battery for the Model 3 is expected to pave the way for such battery suppliers to ride the long-term EV and energy storage system (ESS) wave, according to the report.

For example, the Model 3 has such features as 30 percent energy density improvement and a 65-kilowatt hour (kWh) battery pack. The 65-kWh pack is more cost-effective than the 90-kWh one on Model X, launched last year with a price tag of $132,000.

"Improved energy density not only helps drive down the cost of the battery pack, but improves the overall efficiency of the car," the report says.

"A lighter battery pack and thus lighter vehicle means less requirement for batteries as less energy is required to move. "This is why we believe the Model 3 can exceed the 200 mile range goal with just 65-kWh of batteries."

The report also says Samsung SDI's earnings will depend on demand in the mid-size to large battery market.

"Samsung SDI is facing short-term headwinds, as previously profitable the small lithium-ion battery is facing both weaker demand from its main customer ― including Samsung Electronics ― and intensifying competition," says the analyst in the report.

"Samsung SDI's earnings growth depends on the adoption of EVs and energy storage systems to boost battery revenues and profits. We believe Samsung SDI is best positioned in our coverage to benefit from the growth in demand from EVs in China and globally."

He also hinted that Model 3 would be a potential threat not just to other EV manufacturers, but to luxury sedan makers. This would help increase demand for EVs, which would also drive up battery sales.

"Comparing Tesla Model 3 to other entry-level luxury sedans, the Model 3 is cheaper, faster and of course cleaner," says the report.

"The Model 3 is targeting a base price of $35,000, which after subsidies would be $28,000 in the U.S. (or $25,000 in California).

"This puts it up against the far bigger ‘entry level luxury sedan' segment such as the BMW 3-series (at $33,000 to $38,000) before subsidies, or mainstream sedans such as the Honda Accord ($22,000 to $34,000) after subsidies."