CHICAGO—With distracted driving on the rise and contributing to the increase in motor vehicle crashes and fatalities, the Property Casualty Insurers Association of America (PCI) is supporting the National Highway Traffic Safety Administration‚€™s (NHTSA) ‚€œOne Text or Call Could Wreck It All‚€??? campaign to stop distracted driving.

Following decades of decline, 2015 data show a steep increase in auto accident frequency and highway fatalities. Historically, NHTSA research has pointed to human factors contributing to 94 percent of auto accidents. Recent PCI analysis finds that distracted driving, in all its forms, is a leading factor in the rise of accidents over the last two years. Furthermore, increased traffic congestion could be another leading factor in more accident frequency. ‚€œAlthough there is no single answer to addressing the problem of distracted driving, there are a number of ways that motorists, policymakers, insurers, and car makers can work together to make roads safer,‚€??? said Robert Passmore, PCI‚€™s assistant vice president, personal lines policy. ‚€œThe implementation and enforcement of distracted-driving laws, which discourage texting while driving and ban handheld cellphone use are an important start. It takes a coordinated strategy combining education, personal responsibility and enforcement to get results.‚€???

Today, 46 states, along with D.C., Puerto Rico, Guam and the U.S. Virgin Islands, ban text messaging for all drivers. All but five states have primary enforcement. Of the four states without an all-driver texting ban, two prohibit text messaging by novice drivers and one restricts school bus drivers from texting.

‚€œIn addition to the public safety concerns regarding the increase in the frequency of auto accidents, data also highlights that the insurance claims costs associated with auto accidents are becoming more expensive and this trend could impact insurance costs,‚€??? said Passmore. ‚€œThe current trend lines make it even more important that we work together in order to avoid unsafe driving behaviors, enact or strengthen laws banning texting and hand-held cell phone use while driving, and expand crash avoidance technology in new cars. Together, this can make our roads safer and lower our insurance costs.‚€???

PCI‚€™s 7 Driving Safety Tips:

| 1.) | ¬ | Whether you‚€™re taking a summer get-away or just running errands around town, we encourage you to buckle up, drive safely and try to be prepared for those who may not. Seat belts save lives and help prevent injuries. Also, make sure kids are in the proper car or booster seats. |

| ¬ | ||

| 2.) | Plan ahead and allow extra travel time. With more people on the roads, often driving in unfamiliar territory, the potential for a traffic crash increases. We encourage motorists to plan their routes in advance when traveling to new destinations, be patient, and allow for extra travel time. | |

| ¬ | ||

| 3.) | Observe speed limits, including lower speeds in work zones. Stay focused on the road and aware of changing traffic patterns caused by construction. Please be cautious of the construction workers themselves, who are often in close proximity to the highway ‚€“ and at great risk. | |

| ¬ | ||

| 4.) |

Avoid distracted driving. When the entire family is traveling in the car, the opportunity for distraction is multiplied. Remember to put the phone down, and never text while driving. Be careful when eating on the run, as lunch can be just as distracting as a cell phone. Buckle up or secure pets in the back of the car. |

|

| ¬ | ||

| 5.) | Beware of crash taxes. Although they have been banned or limited in several states, many cities, counties and fire districts will charge the at-fault driver for emergency response costs in an auto accident. Fees range from $100 to over $2,000 for response services. The average cost is $200. A typical insurance policy does not cover the cost of a fire truck responding to an accident. | |

| ¬ | ||

| 6.) | Have a plan for roadside assistance. If an accident occurs, be wary of unscrupulous towing companies. Have the phone number for your insurer or a roadside assistance program ready so you know who to call. Some towing companies take advantage of drivers after an accident and you could find yourself facing excessive fees or complications recovering your car from the tow yard. | |

| ¬ | ||

| 7.) | Update your proof of insurance. Before hitting the road, make sure to replace any expired insurance identification cards in the event you need to prove you have insurance during a traffic stop. | |

| ¬ |

Additional Resources:

National Safety Council Take Back Your Drive

National Highway Traffic Safety Administration

Follow us on social media @PCIAA use #HeadsUp as we continue to offer important safety tips.

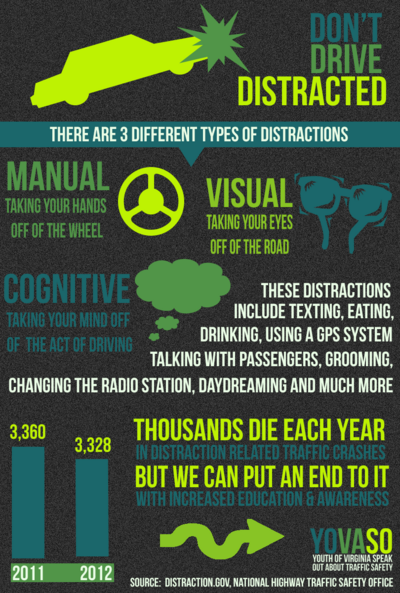

Check out PCI's April Distracted Driving Awareness Infographic

PCI is composed of nearly 1,000 member companies, representing the broadest cross section of insurers of any national trade association. PCI members write more than $183 billion in annual premium, 35 percent of the nation's property casualty insurance. Member companies write 42 percent of the U.S. automobile insurance market, 27 percent of the homeowners market, 32 percent of the commercial property and liability market and 34 percent of the private workers compensation market.