Labor Day Propels New-Vehicle Retail Sales' Strongest Growth So Far in 2015

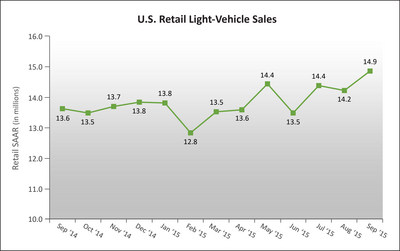

U.S. Retail SAAR-September 2014 to September 2015 (in millions of units). Source: Power Information Network (PIN) from J.D. Power |

WESTLAKE VILLAGE, CA --Sept. 25, 2015: Benefitting from an anomaly on the calendar, new-vehicle sales are headed to double-digit growth in September, with retail sales on pace for the strongest selling rate of any month in more than a decade, according to a monthly sales forecast developed jointly by J.D. Power and LMC Automotive.

For the first time since 2012, Labor Day weekend falls in the industry's September sales month instead of August. Labor Day weekend is traditionally the biggest new-vehicle sales weekend of the year, as consumers take advantage of the holiday and model year-end sales promotions, as well as the availability of the new model-year vehicles arriving in showrooms.

Consumers purchased or leased more than 200,000 new vehicles over Labor Day weekend, or an expected 17 percent of September's sales.

Retail Light-Vehicle Sales

Retail

light-vehicle sales in September 2015 are

projected to approach 1.2 million units, a 10.2 percent increase on a

selling-day adjusted basis compared with September

2014, and the strongest sales volume for the month of September

since 2004 when sales reached 1.2 million units. The seasonally adjusted

annualized rate (SAAR) for retail sales in September

2015 is expected to reach 14.9 million units, an increase of 1.2

million units from the selling rate in September

2014 (13.6 million units) and the highest for any month since July 2005 (16.7 million units). Retail transactions

are the most accurate measure of true underlying consumer demand for new

vehicles.

"Having Labor Day sales count in September definitely gives the month a tremendous lift," said John Humphrey, senior vice president of the global automotive practice at J.D. Power. "On a selling-day adjusted basis, sales through the Labor Day weekend were 72 percent stronger than the same time last year."

While Labor Day weekend is leading the tremendous year-over-year growth, Humphrey noted that the industry remains strong with sales growth even after the holiday. Since Labor Day, sales are up 3 percent compared to the same period a year ago.

Truck sales historically tend to accelerate after Labor Day. So far in September, pickups and SUVs combined account for 57.8 percent of all retail new-vehicle sales, a 3.7 percentage point increase year over year and the highest level since July 2005. Compact SUVs and small SUVs have driven 3.4 percentage points of the increase. Thus far in September, both segments are at their highest share of industry retail sales ever at 15.8 percent and 4.8 percent, respectively, with both segments combined representing one in every five vehicles sold.

Total Light-Vehicle Sales

Total

light-vehicle sales are expected to reach 1.4 million in September 2015, an 8 percent increase on a

selling-day adjusted basis, compared with September

2014. The SAAR for total sales in September is expected to be 17.7

million units, a 1.2 million unit increase from the selling rate in September 2014.

Fleet volume is projected at 241,000 units, a 1 percent increase on a selling-day adjusted basis from September 2014. Fleet sales are expected to account for 17.1 percent of total sales in September 2015, down from 18.4 percent in September 2014 but stronger than the seasonally lower 14 percent level in July and August 2015.

| J.D. Power and LMC Automotive U.S. Sales and SAAR Comparisons | |||

| September 20151 | August 2015 | September 2014 | |

| New-Vehicle Retail Sales | 1,163,500 units2 (10.2% higher than September 2014) | 1,358,251 units |

1,013,925 units |

| Total Vehicle Sales | 1,404,200 units (8.4% higher than September 2014) | 1,574,938 units |

1,243,239 units |

| Retail SAAR | 14.9 million units | 14.2 million units | 13.6 million units |

| Total SAAR | 17.7 million units | 17.8 million units | 16.5 million units |

| 1Figures cited for September 2015 are forecasted based on the first 16 selling days of the month. | |||

| 2The percentage change is adjusted based on the number of selling days in the month (25 days in September 2015 vs. 24 days in September 2014). | |||

Sales Outlook

As a result of the

vigorous selling pace during the spring and summer months—the selling

rate from May through August averaged 17.5 million units—LMC

Automotive is raising its 2015 total light-vehicle sales forecast to 17.2

million units from 17.1 million units and its retail light-vehicle forecast

to 14.1 million units from 14.0 million units.

"The Federal Reserve's decision to keep interest rates at the current level paves the way for the U.S. auto market to post strong results for the remainder of 2015, as the primary risk to volume—a rate increase—is likely pushed out to December or early 2016," said Jeff Schuster, senior vice president of forecasting at LMC Automotive. "Sales the previous three months have significantly exceeded expectations, so if interest rates remain low, auto sales in 2016 will get a further boost from an economy that should accelerate."

North American Production

North

American production in August 2015 was 1.58

million units, a 9.5 percent increase compared with August 2014. U.S. production, with help from strong

SUV demand, has accounted for 70 percent of the volume increase in North

America. Given the strong sales pace, manufacturers

were able to reduce inventory in August to a 55-day supply, down from 59

days in July 2015 and 56 days in August 2014.