Industry Strength Continues in August, Full-Month Volume Impacted by Calendar

|

Retail Sales Expect to Slip 1.2 Percent Due to Labor Day Shift to September

WESTLAKE VILLAGE, CA -- Aug. 27, 2015: Due to a quirk in the calendar, total and retail new-vehicle sales in August are expected to be lower than they were a year ago, according to a monthly sales forecast developed jointly by J.D. Power and LMC Automotive.

For the first time since 2012, new-vehicle sales over the Labor Day weekend will be tallied as part of September's sales rather than counted in August's number. Even when the Labor Day holiday falls in early September, its sales are often part of the August total, but not this year when the holiday lands on Sept. 7.

Labor Day weekend is traditionally the biggest new-vehicle sales weekend of the year, as consumers take advantage of holiday and model year-end sales promotions as well as the availability of new model-year vehicles arriving in showrooms. In 2014, the Labor Day holiday weekend coincided with the close of the August sales month, boosting that weekend's sales to 278,878 units, 20 percent of August sales.

Retail Light-Vehicle

Sales

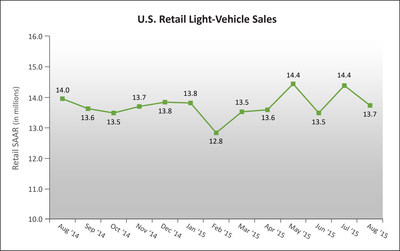

New-vehicle retail sales are projected to hit 1.3 million

units in August, a 1.2 percent decrease on a selling-day adjusted basis,

compared with August 2014. The seasonally

adjusted annualized rate (SAAR) for retail sales in August 2015 is expected to be 13.7 million units, a

decrease of 220,000 units from the selling rate a year ago. Retail

transactions are the most accurate measure of true underlying consumer

demand for new vehicles.

"On a year-over-year basis, August sales are going to appear weak, when in fact it's really a variance in the numbers created by the calendar," said http://schema.org/Person">John Humphrey, senior vice president of the global automotive practice at J.D. Power. "There certainly is no cause for alarm. In fact, the daily selling rate month-to-date in August is trending 8 percent higher than the same period a year ago, although we do anticipate the absence of the holiday in August sales will diminish that rate by the end of the month.

"Our expectation is that with Labor Day falling in September, sales that would have occurred this month are being pushed into next month. If that happens, September will move sales back to the strong trend line we've been seeing throughout the year."

Humphrey noted that continued high transaction prices on new vehicles demonstrate the continuation of the overall health of the industry. The average new-vehicle retail transaction price so far in August is $29,786, on pace to achieve a new record for the month. "We expect consumer spending on new vehicles in August to reach $39 billion, surpassing May 2015 as the fourth highest level on record," said Humphrey.

The current retail transaction price record for the month was set in August 2014, when prices averaged $29,239, according to the Power Information Network (PIN).

Total Light-Vehicle Sales

Total

light-vehicle sales are expected to reach 1.5 million in August 2015, a 0.2 percent decrease on a

selling-day adjusted basis, compared with August

2014. The SAAR for total sales in August is expected to be 17.2

million units, a 100,000 unit decrease from the selling rate in August 2014.

An increase in fleet volume, projected at 210,000 units, is expected to offset some of the decline in retail sales in August. Fleet share of total sales is projected at 13.8 percent in August.

| J.D. Power and LMC Automotive U.S. Sales and SAAR Comparisons | |||

| August 20151 | July 2015 | August 2014 | |

| New-Vehicle Retail Sales | 1,311,600 units2 (1.2% lower than August 2014) | 1,291,491 units |

1,378,588 units |

| Total Vehicle Sales | 1,521,500 units (0.2% lower than August 2014) | 1,508,866 units |

1,583,396 units |

| Retail SAAR | 13.7 million units | 14.4 million units | 14.0 million units |

| Total SAAR | 17.2 million units | 17.5 million units | 17.3 million units |

| 1Figures cited for August 2015 are forecasted based on the first 19 selling days of the month. |

| 2The percentage change is adjusted based on the number of selling days in the month (26 days in August 2015 vs. 27 days in August 2014). |

Sales Outlook

Robust performance in July

is helping drive an increase in the outlook for retail light-vehicle sales

in 2015. LMC Automotive is holding its 2015 total light-vehicle sales

forecast at 17.1 million units, but the forecast for retail light-vehicle

sales has been increased to 14.0 million from 13.9 million units for the

year.

"The current stock market volatility does not seem to be having much of a negative impact on consumers as the selling rate remains well above 17 million units," said http://schema.org/Person">Jeff Schuster, senior vice president of forecasting at LMC Automotive. "Upside potential for the U.S. auto market is gaining momentum, as it now looks unlikely there will be an interest rate increase in September, and a delay in rising rates will most certainly assist in keeping growth on track."

North American Production

North

American production in July 2015 was 1.31

million units, a 6 percent increase compared with July 2014. Nearly all of the year-over-year

increase is attributed to the continued strong demand for SUVs, as 80

percent of the production growth is from SUV volume. Even with higher

overall production volume, manufacturers reduced inventory in July to a

59-day supply, down from 61 days in June 2015

and August 2014. LMC Automotive's production

forecast for 2015 remains at 17.5 million units, a 500,000 unit increase,

compared with 2014.