J.D. Power and LMC Automotive Report: New-Vehicle Retail Sales SAAR in July to Hit 14 Million, Highest Level for the Month in a Decade

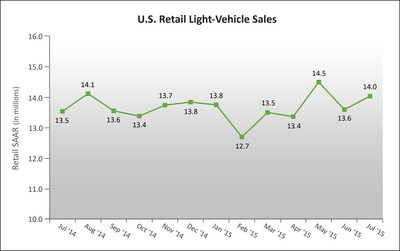

U.S. Retail SAAR-July 2014 to July 2015 (in millions of units). |

WESTLAKE VILLAGE, CA -- July 24, 2015: The U.S. new-vehicle retail seasonally adjusted annualized selling rate (SAAR) in July is expected to reach 14.0 million units, its highest level for the month since 2005, according to a monthly sales forecast from J.D. Power and LMC Automotive.

Retail Light-Vehicle Sales The new-vehicle retail SAAR in July is nearly 500,000 units higher than July 2014 and is the strongest July since 2005 when the SAAR reached 16.7 million driven by automakers' "employee pricing for everyone" promotions.

The forecast for new-vehicle retail sales in July 2015 is 1,260,200 units, a 2.5 percent increase compared with July 2014 and the highest retail sales volume for the month since July 2006, when sales hit 1,294,085. Retail transactions are the most accurate measure of consumer demand for new vehicles.

"The industry continues to outperform prior-year levels with respect to retail sales and transaction prices," said John Humphrey, senior vice president of the global automotive practice at J.D. Power. "The average new-vehicle retail transaction price so far in July is $29,673, on pace to achieve a new record for the month."

The current retail transaction price record for the month was set in July 2014, when retail transaction prices averaged $29,428, according to the Power Information Network (PIN).

The combination of strong sales and high transaction prices positions July consumer spending on new vehicles to reach $37.4 billion, the highest level for the month since July 2005 and an increase of $1.2 billion compared with July 2014. Through the first seven months of 2015, consumers are projected to spend $243.3 billion on new vehicles, exceeding the total for the full year in 2009 ($227.2 billion).

The industry continues to source much of its retail sales growth from SUVs. The largest segment in July 2015 is compact SUV, which has grown its share of industry by 0.9 percentage points from July 2014 and has doubled in size since 2005. The segment with the strongest year-over-year growth in July 2015 is small SUV, which has grown 1.7 percentage points from last July. Additionally, the small SUV segment has increased its share of industry eightfold since 2005, when it represented only 0.5 percent of retail sales.

The largest year-over-year decline in segment size is midsize car, which has dropped 1.2 percentage points of market share compared with July 2014, but is up 4.3 percentage points from July 2005. The large pickup segment has experienced the largest share decline (6.8 percentage points) since July 2005, when it was the market share leader. In July 2015 it has dropped to the fifth largest segment. However, the large pickup segment is up 0.5 percentage points in July 2015 compared with July 2014.

Total Light-Vehicle Sales Total light-vehicle sales in July 2015 are projected to reach 1,478,700, a 3 percent increase from July 2014. Fleet volume in July is expected to reach 218,500 units, down 32 percent on a selling-day adjusted basis from June 2015. Fleet share of total sales falls from June to comprise 15 percent of industry sales, a 1 percentage point increase from July 2014.

| J.D. Power and LMC Automotive U.S. Sales and SAAR Comparisons | |||

| July 20151 | June 2015 | July 2014 | |

| New-Vehicle Retail Sales | 1,260,200 units (2.5% higher than July 2014) | 1,166,422 units |

1,229,053 units |

| Total Vehicle Sales | 1,478,700 units (3% higher than July 2014) | 1,475,062 units |

1,432,938 units |

| Retail SAAR | 14.0 million units | 13.6 million units | 13.5 million units |

| Total SAAR | 17.2 million units | 17.1 million units | 16.4 million units |

| 1Figures cited for July 2015 are forecasted based on the first 15 selling days of the month. | |||

"Light-vehicle sales continue to be on track after June ended right at expectations, continuing a great run for auto sales," said Jeff Schuster, senior vice president of forecasting at LMC Automotive. "The industry has found its groove and consumers continue to respond and make purchases, replacing their aging or off-lease vehicles."

North American Production North American production in June 2015 was 1.56 million units, a 5 percent increase over both June 2014 and May 2015. Production through the first half of the year is up 220,000 units (2.5%) compared with the same period last year. Given the brisk production output in June, manufacturers boosted inventory to a 61-day supply, up from 56 days in May and 60 days in July 2014.

Helping to drive the growth through the first half of the year is the increasing popularity of SUVs in the North American market. SUV output in 2015 increased by nearly 200,000 units through June compared with the same period last year. Aiding the SUV growth for the period was the significant reduction of midsize van output due to shutdown activity, which ultimately benefitted the midsize and large SUV segment vehicles. LMC Automotive's production forecast for 2015 remains at 17.5 million units, a 500,000 unit increase compared with 2014.