Cox Automotive Owner of Kelley Blue Book and Autotrader to Buy Dealertrack for $4 Billion

|

EDITORS' NOTE: Wow! 4 billion dollars to buy a company that helps dealers make more money from auto shoppers like you (see Dealertrack brag below release); Dealerships selling for unbelievable prices, Third-party lead generators including TrueCar (a bullshit company), Cars.com, Auto Trader, Edmund's, KBB, valued at a billions of dollars), While concurrently AutoNation is bragging that they are spending $100 million to allow their dealerships to eliminate and replace third party lead generators...WTF. Will all of these high finance mergers and buyouts encourage car buyers to become more comfortable and confident in buying directly from their local dealer; result in car buyers getting smarter(no);result in getting a fair price (no), result in buyers feeling better about a deal they are getting (well maybe). As the pioneer online automotive provider of honest, consumer oriented information we are amazed that in-spite of the Internet hype the number of cars sold here in the U.S has not been stimulated ...what don't we get?

Sandy Schwartz, the Cox Automotive president: “This is a great investment in our customers and in the auto industry. Integrating our platforms will be a big step forward in our shared vision of providing open, cost-effective and efficient solutions for dealers, lenders, manufacturers and (oh yeah my comment) consumers.

|

Cox Automotive will acquire Dealertrack in an all-cash transaction valued at $4 billion, or $63.25 per share. The acquisition is subject to a minimum tender of at least a majority of the outstanding Dealertrack common shares and customary closing conditions, and is expected to close in the third quarter of 2015. The Dealertrack Board of Directors has unanimously approved the acquisition and recommends that Dealertrack stockholders tender their shares in favor of the transaction.

The combination of Cox Automotive and Dealertrack will create a broader suite of open solutions that deliver greater value to consumers, dealers, lenders, manufacturers and the overall automotive industry. Dealertrack's broad solution set for dealers is an excellent complement to Cox Automotive's vehicle remarketing services and digital markets and software solutions that serve the wider automotive ecosystem. In addition, the combination will better serve customers across global markets through each company's respective international footprint. Together, Cox Automotive and Dealertrack will be well positioned to help customers grow their businesses and increase efficiencies as they navigate a rapidly changing global automotive industry.

"This is a great investment in our customers and in the auto industry," said Sandy Schwartz, President of Cox Automotive. "We have long admired the Dealertrack team and its highly respected brands. Integrating our platforms will be a big step forward in our shared vision of providing open, cost-effective and efficient solutions for dealers, lenders, manufacturers and consumers. We look forward to working with Mark O'Neil and his team as Mark continues to lead the acquired businesses and as we continue to innovate for our customers."

Mark O'Neil, Chairman and Chief Executive Officer of Dealertrack, said, "I am confident that with Cox Automotive, we will fully unlock the potential of our combined brands and teams in the service of our clients. Dealertrack team members have been a critical element in the tremendous success our company has achieved, and I want to thank all of our team members as we move forward into this exciting new chapter of growth. I am extremely enthusiastic about our future with Cox Automotive."

O'Neil added, "This provides a significant premium and immediate cash value for Dealertrack stockholders at closing. After careful and thoughtful analysis, with the assistance of our independent legal and financial advisors, we concluded that this transaction provides our stockholders with the opportunity to tender their shares at a price that recognizes the superior value of Dealertrack's industry partnerships, solutions, technology, financial management and international industry position."

The transaction is fully financed and is not subject to a financing condition. The acquisition will be funded through an existing bank facility, a new $1.85 billion bank term loan arranged by Citigroup Global Markets Inc. and a $750 million common equity investment from BDT Capital Partners.

BDT & Company and Citigroup Global Markets are serving as financial advisors, and Wachtell, Lipton, Rosen & Katz is serving as legal counsel to Cox Automotive. Evercore is acting as financial advisor and O'Melveny & Myers LLP is serving as legal advisor to Dealertrack.

About Cox Automotive (www.coxautoinc.com)

Cox Automotive is a leading provider of vehicle remarketing services and digital marketing and software solutions for consumers, dealers, manufacturers and the overall automotive industry. Cox Automotive includes Manheim®, Autotrader®, Kelley Blue Book®, vAuto®, Xtime®, NextGear Capital®, and a host of global businesses and brands. Headquartered in Atlanta, Cox Automotive employs nearly 24,000 employees in over 150 locations worldwide. The company partners with more than 40,000 dealers, as well as most major automobile manufacturers, and touches car buyers in the U.S. with the most recognized brands in the industry. Cox Automotive unites more than 20 brands in this space, providing an end-to-end solution to transform the way people buy, sell and own cars every day. Cox Automotive is a subsidiary of Cox Enterprises, an Atlanta-based company with revenues of $17 billion and approximately 50,000 employees. Cox Enterprises' other major operating subsidiaries include Cox Communications (cable television distribution, high-speed Internet access, telephone, home security and automation, commercial telecommunications and advertising solutions) and Cox Media Group (television and radio stations, digital media, newspapers and advertising sales rep firms).

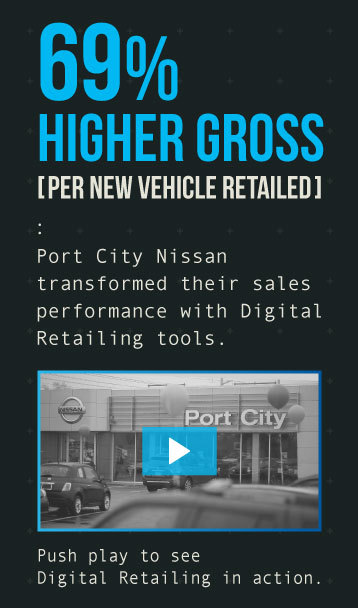

About Dealertrack (www.Dealertrack.com)

Dealertrack's intuitive and high value web based software solutions and services enhance efficiency and profitability for all major segments of the automotive retail industry, including dealers, lenders, vehicle manufacturers, third party retailers, agents and aftermarket providers. In addition to the industry's largest online credit application network, connecting more than 20,000 dealers with more than 1,500 lenders, Dealertrack delivers the industry's most comprehensive solution set for automotive retailers, including Dealer Management System (DMS), Inventory, Sales and F&I, Digital Marketing and Registration and Titling solutions.