New Survey Shows Concern Over Fuel Prices and Environment Drive Consideration of Hybrid Electric Vehicles to Highest Level Ever

|

DETROIT, June 19 -- According to a new survey by global market research firm Synovate, US consumers are more familiar with advanced propulsion systems compared to a year ago, with turbo gasoline direct injection, direct injection diesel and hybrid electric vehicles the best known systems.

"We are fast approaching the 'perfect storm' facing our advanced technologies," says Tim Englehart, vice president for Synovate Motoresearch, the automotive research division of Synovate, and head of the study. "The combination of rational and emotional purchase behaviors is not as aligned as in the past," continues Englehart.

|

"While fuel economy is climbing in terms of purchase reasons, it still has not penetrated the top 10 reasons for purchasing a new vehicle," says Scott Miller, CEO of Synovate Motoresearch. "Consumers are not willing to sacrifice safety, reliability and value for the money," adds Miller.

High fuel prices and concerns about the environment influence consumers' consideration of hybrid-electric vehicles, while these same concerns flatten direct injection diesel consideration. Consumers cite battery concerns as a leading reason for not considering battery-electric and plug-in hybrid vehicles although many look past this issue for hybrids in general, driving it to its highest consideration ever.

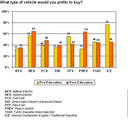

Interestingly, Synovate found that after respondents had an opportunity to read about the pros and cons of each of these technologies, attitudes shifted -- particularly in favor of plug-in hybrids and away from the traditional gasoline engine.

What type of vehicle would you prefer to buy?

"This shows that consumers are still confused by the choices of alternative propulsion technologies and their relative advantages," says Miller. "Manufacturers need to do a better job of communicating the benefits to potential buyers. For example, our survey shows that purchase consideration of plug-in hybrids almost doubles when respondents learn what it actually is, while consideration for flex-fuel vehicles drops significantly after respondents learn about their benefits and liabilities."

A key barrier to purchasing a vehicle that uses an alternative engine technology is the availability of fuel. Consumers remain convinced that filling stations need to carry the alternative fuel before they will consider buying a vehicle that runs on it. This perception has not changed in the past several years.

"Consumers also need to believe there is a long-term plan for sustaining these new technologies," adds Miller. "They don't want to invest in an alternative fuel vehicle unless they have peace of mind that the refueling infrastructure as well as parts and service will be available for many years to come."

Consumers also consider Toyota and Honda the top two manufacturers in bringing these new technologies and alternatively fueled vehicles to market, with both rated significantly better than all other brands. Among energy companies, BP and Shell are perceived to be making the best effort at marketing alternative fuels, followed closely by ExxonMobil and Chevron.

"Unfortunately, there seems to be a direct link to the price of fuel and satisfaction with the efforts of manufacturers in bringing new technologies and alternative fueled vehicles to market," says Englehart. "When the price of fuel increases slightly, satisfaction continues to increase for manufacturers but when the increase is significant, then satisfaction for manufacturers is negatively impacted."

Nearly two-thirds of American consumers will look for a vehicle that reduces their monthly fuel expense when considering their next purchase of a vehicle, according to the survey. What's more, nearly three-fourths of respondents said they will consider paying $1,500 more for a vehicle that achieves 30% better fuel economy than a comparable model. The survey also revealed that consumers are willing to pay an extra $2,000 for a vehicle that is significantly better for the environment.

Additionally, consumers feel that both state and federal governments should be highly involved in the development or sponsorship of technologies that use alternative fuels but most feel both government levels are failing to do so.

"While California residents are less likely to blame their state government in comparison to other states, respondents across the nation feel the federal government's performance is subpar when it comes to developing alternative fuels," says Englehart.

About Synovate

Synovate, the market research arm of Aegis Group plc, generates consumer insights that drive competitive marketing solutions. The network provides clients with cohesive global support and a comprehensive suite of research solutions. Synovate employs over 5,800 staff in 121 cities across 57 countries.

For more information on Synovate visit http://www.synovate.com/.