Wi-Fi in Your Car: GM-Initiated Feature Appears Hot with Influential Consumer Type

By Jennifer Sikora

CivicScience

With the massive surge in smartphone ownership in the past few years (over 64% of U.S. adults now use one, according to both CivicScience and Pew Research), the devices are inevitably used by passengers in cars. Being able to browse the web, stream video or audio services, and interact with apps are all activities that burn through data plans due to the lack of Wi-Fi availability while on the road. This opportunity was likely clear to General Motors which last fall started to offer, for a monthly fee, its own Wi-Fi service in several of its car models within the Chevrolet, Buick, GMC, and Cadillac lines.

Was this a good move for a car manufacturer who had in recent years suffered significantly due to ignition recalls and lawsuits resulting from fatal casualties?

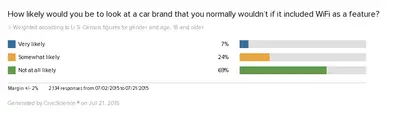

In early July 2015, CivicScience asked over 2,000 U.S. adults

whether Wi-Fi as a feature would be compelling enough to lure more test

drivers who normally wouldn't look at that particular car brand.

Thirty-one percent of U.S. adults indicated that they would be either somewhat or very interested in looking at a car brand they hadn’t thought about, if it included Wi-Fi as a feature. So these “interested consumers” represent a decent share of the market.

According to General Motors investor sales report, the company has experienced positive growth and profits in the retail sector in the last several months, having the most successful June since 2007. Total retail deliveries are up 7% since 2014, coming to a 2.8% increase in market share for the company.

Obviously this data doesn't directly tell us whether consumer interest in vehicle Wi-Fi has led to increased sales for General Motors (nor did we find any other research indicating such a link), but we can learn plenty about the kinds of consumers who are intrigued by the offer.

We did learn that they are overt technophiles and bigger followers of media and entertainment trends, and that women have more interest in such features. Here is more detail, starting with demographics:

- Car Wi-Fi is received a bit better by women, who are 29% more likely to say they’d be “Very likely” and slightly more likely to say they’d be “Somewhat likely” to consider a brand because of a Wi-Fi offering.

- Parents are slightly more likely to answer “Somewhat likely.”

- Grandparents are slightly more likely to answer “Not at all likely.”

In terms of other demographics (age, education, income) the data wasn’t different from the average in a statistically significant way. It seems interest/disinterest in cars with integrated Wi-Fi is not specific to a certain age group, educational status, or socioeconomic bracket, but instead is more closely linked to personal preferences and attitudes.

Looking at technology preferences, for example, we learned that interested consumers, when compared against the average…

are 44% more likely to follow trends in electronics and technology very closely.

are 35% more likely to say that they like mobile phone/tablet apps.

are 71% more likely to be very likely to buy Apple products in the near future.

are 33% more likely to use their smart-phone to make mobile payments.

Car brand manufacturers like General Motors can tap into this group for their technophile tendencies, as these consumers are much more likely to value Wi-Fi in their cars so that they can connect to mobile devices while on-the-go.

In terms of entertainment, interested consumers compared against the average are…

59% more likely to closely follow trends and current events in the TV and movie industry.

56% more likely to say that they love Netflix. 48% more likely to closely follow trends and current events in music.

37% more likely to use music streaming services.

This gives us an idea of how the WiFi would be used, but also how GM’s marketing and ad teams might better reach this potentially “convertible” audience.

Another marketing concern may be the need for GM (or other brands considering this strategy) to also direct some safety recommendations to its target audiences. In 2015, 26% of consumers admitted to texting behind the wheel, and texting and driving is now seen as a bigger problem than drunk driving. If car manufacturers plan to push Wi-Fi services for users behind the wheel, they may want to be clear that texting and web surfing by drivers is not recommended.

Lastly, we noticed that consumers interested in checking out a car brand for its Wi-Fi also fall into a category we call “Market Mavens.” When compared against the average, consumers interested in this Wi-Fi offering are…

28% more likely than average to try new products before other people do.

30% more likely to tell others about new brands or technology.

This could be very good news for GM. The Market Maven group is important to companies that sell consumer goods because they tend to have a powerful effect on the purchasing decisions of other consumers. Market Mavens tend to branch out more often and try new products, as well as blog or talk about it, influencing the opinions of others.

So the profile of those interested in Wi-Fi enabled cars is more likely to be female and slightly more likely to be a parent. This consumer is very interested in technology, media and entertainment, and also has some Market Maven tendencies, which may encourage these potential buyers to test drive these models before their peers, and then share opinions of it with others.

Not a bad mix for GM. The target audience that does some brand-building for you can make a real difference to business. May they share, like and Tweet with their cars safely in park!

About the CivicScience Methodology

CivicScience collects real-time consumer research data via polling applications that run on hundreds of U.S. publisher websites, cycling through thousands of active questions on any given day. Respondents for this report were weighted for U.S. Census representativeness for gender and age, 18 years and older, and data was collected from non-incented opt-in respondents answering poll sessions from July 2, 2015 through July 21, 2015.