Buying The Electric Marketplace

|

Gary S. Vasilash

Transportation Editor

Gardner Business Media

Serious Money for Going EV

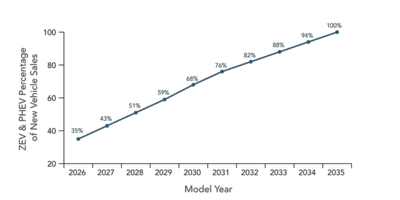

This is how California intends for things to go. (Image: CARB)

Some people still wonder about the viability of the transition to electric vehicles.

Some recent numbers from California—which, before you do an eye-roll, realize represents approximately 12% of all new passenger vehicle sales in the U.S.—underscore the reality of the transition. . .

Like $2.6 billion

That’s what the California Air Resources Board is investing in “clean” cars, trucks and mobility options.

While $381 million will be spent on clean transportation equity projects—like up to $15,000 in incentives for low-income consumers buying a new EV and $19,500 if they scrap an older vehicle as part of that transaction--$2.2 billion will be dispersed:

- >$2 billion for vehicles including school buses, transit buses and drayage trucks

- $33 million for small truck fleets transitioning to cleaner tech

- $135 million for demo and pilot projects

Another number:

$10 billion

That’s the amount that California is spending (including that $2.6 billion) to work toward the decarbonization of its transportation sector.

Also:

2035

The year that the state expects to have 100% of new car and medium truck sales be electric.

And:

2045

The year that new heavy-duty trucks are to be zero emissions.

One more:

40

The following states have adopted California’s vehicle standards under Section 177 of the Federal Clean Air Act:

- New York

- Massachusetts

- Vermont

- Maine

- Pennsylvania

- Connecticut

- Rhode Island

- Washington

- Oregon

- New Jersey

- Maryland

- Delaware

- Colorado

- Minnesota

All-in, these states and California account for about 40% of all new vehicle sales in the U.S. Although they haven’t all signed on for California’s 2035 and 2045 rules, this is group is an important part of the total market.

This is not to say that internal combustion engines are going away (as previously mentioned in the Audi piece above).

But if you’re investing in future capacity, ICEs are probably not the place to spend a whole lot doing it.

///

What the IRA Could Mean to EV Sales

The Nissan Leaf EV is built in Tennessee—which is a plu$ for IRA qualification. (Image: Nissan)

While on the subject of dollars and electric vehicles. . .

The Inflation Reduction Act (IRA) of 2022 is the law that includes adjusted figures for electric vehicle tax credits as well as new sourcing requirements relative to EVs.

For example, starting next year there is a $7,500 tax credit available for the purchase of an EV if. . .

- The vehicle is assembled in North America

- At least 40% of the critical minerals in the battery are sourced (new mining, processing, recycling) in the U.S. or a country with which the U.S. has a free-trade agreement

- At least 50% of the battery components are made or assembled in the U.S. or a country with which the U.S. has a free-trade agreement

- The car, hatch or wagon costs $55,000 or less

- The SUV or truck costs $80,000 or less

- A single tax filer’s adjusted gross income is $150,000 or less; a head of household filer is at no more than $225,000, and a joint filer earns no more than $300,000

Seemingly there are more moving parts in those figures than there are in an EV powertrain (and we haven’t even mentioned the annual changes that will occur vis-à-vis mineral and battery component content).

Who Knows How Much?

Cox Automotive analysts were interested in knowing what consumers know of and think about the IRA as it relates to EVs (there are plenty of other items in the act, ranging from prescription drug prices to IRS enforcement).

So it conducted a survey in September (the act was signed in mid-August) among 1,000 consumers.

And one of the least remarkable findings of all time is that 32% said they are “somewhat familiar” with the EV tax credit elements of the IRA. (Let’s face it: “somewhat” is a fairly wide-ranging adjective, something that almost anyone in good conscious could probably say even if they only know that there are EV tax credits involved.)

Fifteen percent say “extremely familiar” and 16% “very familiar,” or a total of 63% in the familiarity camp. (Heck, I wrote those bullet points above and I don’t consider myself to be familiar with what’s what.)

On the other side, 14% are “not at all familiar” and 23% are “not very familiar,” so there are 37% who are to some extent in the dark.

Which means dealers and OEMs, in particular, have a lot of educational work ahead of them—on top of explaining what things like MPGe and DC fast-charging are.

But apparently the IRA is going to make more people inclined to go EV.

Looks Like They’ll Buy

Twenty-two percent “strongly agree” and 28% “somewhat agree” that receiving a tax credit would encourage them to buy an EV.

On the other side, 17% “strongly disagree” and 8% “somewhat disagree.”

So there is 25 point delta to the “agree” advantage.

(And yes, 25% “neither agree nor disagree.”)

Economic Advantage

For those who are interested in what used to be called “industrial policy,” there is a notable finding from Cox.

When asked whether they agree with “The EV tax credit will be good for the economy”

- 22% strongly agree

- 30% somewhat agree

- 28% neither agree nor disagree

- 8% somewhat agree

- 12% strongly disagree

So assuming they can get that tax credit figured out, there will be more customers for EVs as a result of the IRA and the economy will be better for it.