DUBLIN--(BUSINESS WIRE)--The "Automotive Testing Inspection And Certification Market - Forecasts from 2022 to 2027" report has been added to ResearchAndMarkets.com's offering.

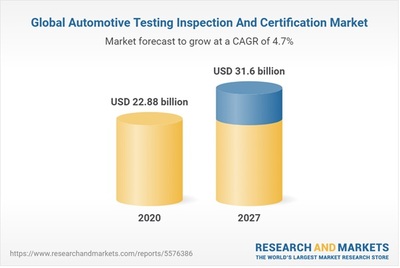

The automotive testing inspection and certification market was valued at US$22.881 billion in 2020 and is expected to grow at a CAGR of 4.72% over the forecast period to reach a total market size of US$31.600 billion by 2027.

The automotive testing, inspection, and certification (TIC) services are used to provide services to automotive TIC producers in order to improve efficiency, productivity, and the production process in order to achieve the necessary requirements. Furthermore, the use of smart sensors in vehicles, such as radar, light detection and ranging, and others, has enabled remote monitoring and prediction of maintenance capabilities, reducing the need for on-site inspection.

As a result, technological developments in TIC like virtual reality (VR) and augmented reality (AR) will aid in the replacement of physical vehicle inspection with digital inspection. Hence, in the near future, the replacement of physical inspection with digital inspection and predictive maintenance is projected to fuel the growth of the worldwide automotive testing, inspection, and certification market.

The rise in automobile manufacturing in emerging nations, as well as the quick shift in attitude toward outsourcing TIC services, are significantly affecting the growth of the automotive testing, inspection, and certification market. The increasing disposable incomes in emerging nations, as well as the increased focus of governments on imposing rigorous regulatory requirements on the automobile sector, are expected to fuel the expansion of the automotive testing, inspection, and certification market. Furthermore, the use of automotive electronics to ensure passenger and vehicle safety is projected to drive the growth of the automotive testing, inspection, and certification market during the forecast period.

However, the automotive testing, inspection, and certification market have certain limitations that are expected to obstruct the market's potential growth, such as varying regulations or standards across regions and declining global vehicle sales, while the long lead time required for overseas qualification tests can challenge the market's growth.

The Asia Pacific holds the majority of the global market and is expected to maintain its dominance during the projected period. The developing economies in this region, rising per capita income, rising demand, and more investment possibilities due to favorable government policies are attracting the attention of automobile manufacturers, who are looking to expand their production capacity in this region.

This, in turn, leverages the technological revolution of the automobile production and service industries, resulting in the region's strong market growth. Furthermore, rising auto sales and production, rising demand for premium and autonomous vehicles, rising inclination toward electric cars, stringent government policies for vehicle safety and quality, and technological advancement in the automotive industry are encouraging automakers to expand in the market, thereby boosting automaker growth.

Growth Factors:

There is increasing demand for automobile safety and quality:

The global automobile industry is supervised by a variety of government rules regulating passenger safety as well as environmental issues (emission levels, fuel economy, noise, and pollution). These regulations/standards have a direct impact on and affect the design of automotive parts. Strict government regulations require automakers to include safety equipment like seatbelts, airbags, and crumple zones in their vehicles.

Major regulatory organizations impose tariffs and other trade obstacles to penalize and deter producers from violating pollution and safety standards, such as the continuous use of faulty equipment Tariffs and other trade obstacles are imposed by major regulatory organizations to penalize and deter producers from violating pollution and safety standards, such as the continuous use of faulty equipment.

This compels automakers to create fuel-efficient vehicles with significantly lower emissions, as well as add safety features such as anti-skid braking systems (ABS), electronic brake-force distribution (EBD), airbags, and emission control systems such as catalytic converters with turbochargers and exhaust gas recirculation (EGR) systems.

Restraints:

Regulations and/standards differ across regions:

With the globalisation of trades and companies, specific regional regulations and standards are likely to create hurdles to product adoption on a global scale. This leads to disputes between local and international standards, impeding market expansion. Variations in regulatory requirements across different regions result in disparities in tax rates, incurring additional expenditures for businesses (hiring local staff to handle tax-related issues, etc.). Local regulations apply to TIC businesses, and they are required to obey the laws and norms of the countries in which they operate, which might limit their efficiency.

Market Segmentation

By Service

- Testing

- Inspection

- Certification

By Sourcing

- Outsourced

- In-house

By Application

- Telematics

- Electrical Systems & Components

- Interior & Exterior Material

- Homologation Testing

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- France

- Germany

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- Thailand

- Taiwan

- Indonesia

- Others

Companies Mentioned

- Bureau Veritas S.A.

- SGS SA

- Dekra Group

- Intertek Group Plc

- TUV SUD

- BSI Group

- TUV Nord Group

- ATIC

- Applus+

- NTS

For more information about this report visit here