Demand for residual fuel oil in the United States increased in late 2021, yet domestic production remains low

|

Snides Remarks - Could this have been done purposely?

Washington DC February 2, 2022; In November 2021, there was more consumption of residual fuel oil (RFO) in the United States, measured as product supplied, than for any month since January 2017. Consumption then set a series of weekly five-year (2016-2020) highs in December, according to our Weekly Petroleum Status Report (WPSR). RFO is primarily consumed as vessel bunker fuel in the maritime shipping sector. The increase in RFO consumption comes with record increases in maritime shipping volumes and rising high-sulfur fuel oil (HSFO) prices in Singapore. RFO inventories fell to five-year lows during this period of strong consumption. In addition to increased demand, low inventories also reflect less refinery production of RFO on a sustained basis as a result of longer-term market changes.

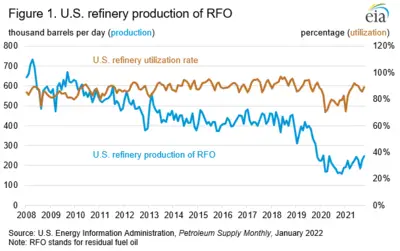

Until the end of 2019, U.S. refinery production of RFO exceeded 300,000 barrels per day (b/d). In December 2019, production fell to 242,000 b/d and has not risen above 300,000 b/d since then, according to WPSR. Beginning on January 1, 2020, the International Maritime Organization’s (IMO) tighter regulations on maritime fuel sulfur specifications went into effect. Fuel producers and shippers anticipated that the new regulations would disrupt the marine shipping industry over the course of 2020. Expecting a related decrease in HSFO demand in 2020, many U.S. refiners began reducing their yield of HSFO in 2019 or earlier, or RFO more broadly, to avoid overproduction prior to the new regulation taking effect.

Substantially less refinery production prompted by the effects of the COVID-19 pandemic since the spring of 2020 has also contributed to lower overall production of RFO, which is largely considered a refining byproduct (Figure 1). Refinery crude oil inputs and overall operations have been lower since the early 2020 start of the COVID-19 pandemic because of less demand for higher-value refined products such as gasoline and distillate. Refinery inputs have remained low in 2021, in part, because of refinery capacity closures that occurred during 2020.

Refinery yield of RFO is primarily determined by the quality of the crude oil processed and the technological configuration of the processing refinery. Crude oil grades with a low API gravity tend to produce a larger share of RFO and other low value residuum compared with higher API crude oils. Refineries can compensate for lower API crude oil by incorporating secondary unit conversion capacity into their refinery processes, which convert residuum and increase the overall facility yield of higher value products such as motor gasoline, light naphtha, and middle distillates. Secondary unit capacity additions are time- and capital-intensive investments.

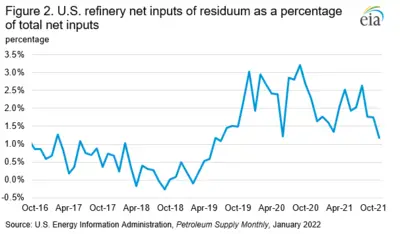

Beginning in late 2019, refineries began to shift from selling residuum to end users as RFO to using it as a secondary refinery input (Figure 2). Prior to 2019, net refiner inputs of residuum measured 1% or less of total net inputs. However, the specification shift brought on by the changing IMO regulations contributed to increased net inputs of residuum because refiners with sufficient conversion capacity purchased or reused discounted residuum as a feedstock instead of distributing it as fuel oil. By the end of 2019, and throughout most of 2020 and 2021, net residuum inputs to refineries were between 1.5% and 3.5% of total inputs, falling below that range on a monthly average basis only twice in the past two years, according to our Petroleum Supply Monthly (PSM).

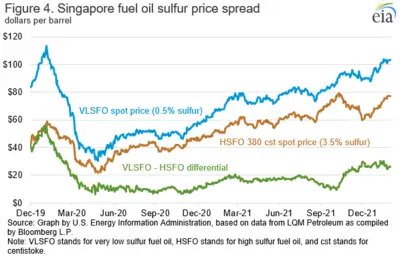

Prior to the IMO specification change, most RFO that was consumed in the global maritime shipping sector contained as much 3.5% sulfur, categorized as HSFO. Beginning in 2020, the IMO required ships to switch to fuels with a 0.5% sulfur content or less, forcing ships to use a more heavily treated variety of RFO called very low sulfur fuel oil (VLSFO). The change also increased demand for low sulfur marine gasoil (LSMGO), a variation on distillate fuel oil, which also reduced sulfur emissions and demand for RFO while contributing to increasing distillate demand. Ships can comply with the IMO specification as long as their actual emissions meet the target sulfur emissions level, regardless of the fuel consumed. As a result, ship owners could install sulfur scrubbers to reduce sulfur emissions while still consuming HSFO and remain compliant. Although scrubbers are expensive and time consuming to setup and maintain, vessels can lower operating costs by purchasing HSFO instead of higher-priced VLSFO or LSMGO.

Although the IMO regulation applies to global shipping, marine vessels operating along the U.S. coastline or in other areas within the North American or U.S. Caribbean Sea Emission Control Areas (ECA) were already required to meet the 0.1% sulfur content requirement while operating within those waters.

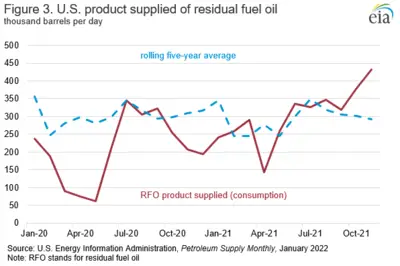

U.S. RFO consumption (measured as product supplied) decreased to well below the five-year low in April and May 2020 (Figure 3). Globally, RFO accounts for a relatively small share of petroleum consumption. Contracting global maritime activity during mid-2020, in response to less international trade, contributed to the decline in RFO consumption. Monthly U.S. consumption returned to levels near their previous five-year average in late summer, however, and remained at near-average levels for much of 2021. The increase in demand may reflect a more rapid increase in international shipping demand, especially for ships that installed sulfur scrubbers in 2020 and later. RFO is also consumed in some markets for electricity generation, but it constitutes less than half a percent of total generation in the United States. However, high international prices for natural gas beginning during the fall of 2021 may have contributed to fuel switching resulting in additional international demand for RFO.

U.S. refinery runs and RFO production remained below pre-pandemic rates for most of 2021, which when combined with near-normal demand levels, contributed to below-average U.S. RFO inventories throughout 2021. In October 2021, U.S. consumption of RFO increased to 25% above the five-year average, further increasing to 48% above the five-year average in November, according to PSM. December consumption has also remained at elevated levels, according to our WPSR.

High crude oil prices indirectly contribute to higher overall bunker fuel prices, and as ship owners look to reduce high fuel costs, they face further incentives to install scrubbers to take advantage of the price discount that 3.5%-sulfur HSFO has to 0.5%-sulfur VLSFO, sometimes called the Hi-5 spread. Since the start of November 2021, the Singapore VLSFO price premium over 380 centistoke HSFO increased to more than $20 per barrel (b) and neared $30/b throughout December and January, the highest it has been since the onset of the COVID-19 pandemic (Figure 4). Growing demand for shipping may be contributing to greater scarcity in the VLSFO market relative to HSFO. High global natural gas prices also increase the price of industrial hydrogen, which is used for hydrotreating units in refineries that are required to reduce the sulfur content in their petroleum fuels. Rising natural gas prices may be indirectly contributing to additional upward price pressure on VLSFO compared with HSFO.

U.S. average regular gasoline and diesel prices increase

The U.S. average regular gasoline retail price increased nearly 5 cents to $3.37 per gallon on January 31, 96 cents higher than a year ago. The East Coast and Midwest prices each increased more than 6 cents to $3.31 per gallon and $3.19 per gallon, respectively, the Gulf Coast price increased 2 cents to $3.03 per gallon, and the Rocky Mountain price increased less than 1 cent, remaining virtually unchanged at $3.33 per gallon. The West Coast price remained unchanged at $4.16 per gallon.

The U.S. average diesel fuel price increased nearly 7 cents to $3.85 per gallon on January 31, $1.11 higher than a year ago. The Gulf Coast price increased nearly 8 cents to $3.61 per gallon, the East Coast price increased more than 7 cents to $3.85 per gallon, the Rocky Mountain and Midwest prices each increased nearly 6 cents to $3.76 per gallon and $3.71 per gallon, respectively, and the West Coast price increased more than 5 cents to $4.54 per gallon.

Residential heating fuel prices increase

As of January 31, 2022, residential heating oil prices averaged nearly $3.78 per gallon, almost 11 cents per gallon above last week’s price and nearly $1.18 per gallon higher than last year’s price at this time. Wholesale heating oil prices averaged almost $2.94 per gallon, nearly 10 cents per gallon above last week’s price and more than $1.22 per gallo¬¬n above last year’s price.

Residential propane prices averaged $2.78 per gallon, almost 4 cents per gallon above last week’s price and more than 57 cents per gallon above last year’s price. Wholesale propane prices averaged more than $1.50 per gallon, nearly 12 cents per gallon above last week’s price and more than 45 cents per gallon above last year’s price.

Propane/propylene inventories decline

U.S. propane/propylene stocks decreased by 4.3 million barrels last week to 49.8 million barrels as of January 28, 2022, 7.0 million barrels (12.4%) less than the five-year (2017-2021) average inventory levels for this same time of year. East Coast inventories decreased by 2.0 million barrels, Midwest inventories decreased by 1.9 million barrels, and Gulf Coast and Rocky Mountain/West Coast inventories each decreased by 0.2 million barrels.