Study reveals almost 1 in 3 Americans have lied on a car insurance application

|

Honesty is key, but it seems some Americans are willing to bend the truth in order to unlock the best insurance policy.

According to a finder.com study <https://www.finder.com/lying-on-insurance>, 35 million Americans have lied on an insurance application with car insurance the most likely type of insurance to bring out our inner liars.

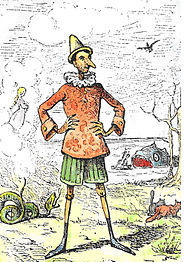

Almost one in three (29%) people who have lied on an insurance application have done so for car insurance. That is a whopping 10.2 million Americans who have ‘Pinocchioed’ their way to scoring the best coverage for the road.

Following car insurance applications fibs are health insurance (22%), life insurance (21%), income protection insurance (8%), travel insurance (7%), home and contents insurance (7%) and pet insurance (5%).

The full report can be found here: https://www.finder.com/lying-on-insurance

When it comes to gender, women are more likely than men to lie on an application in five of the seven categories: health insurance, income protection insurance, travel insurance, home and contents insurance and pet insurance. Men lead ahead of women when it comes to lying on car insurance and life insurance applications.

Your tribe attracts your vibe, considering those who rent their homes (32%) are most likely to deviate from the truth when it comes to car insurance, compared to homeowners (29%) and those who live with their parents or family (28%).

As we look across the map, the study found Arizona leads in having the most citizens likely to lie on insurance, with 25% admitting to lying on an insurance application. Arizona is followed by California (22%) and Ohio (20%).

"Taking creative liberties on your insurance application may seem like an innocent white lie, but it's actually considered fraud, and the repercussions can be serious. If found out you may be charged a higher premium, denied a policy or even charged with fraud, requiring you to pay a fine or even do jail time.

"If you find the need to lie on an application it's likely that your search for the right policy isn't over. Before beginning your search for any policy, determine the requirements you have and the needs an insurer must meet for you to feel financially and physically secure. Always compare insurance policies <https://www.finder.com/insurance> and be upfront about your expectations when speaking with a provider.�??