Have Car, Will Travel

|

In the coming years, where will drivers live and how will they travel?

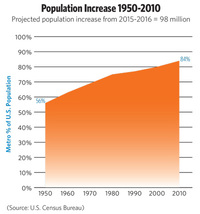

Washington DC June 1, 2016; NACSonline reported that the U.S. population is projected to swell 30% to nearly 415 million by the year 2060. But where will all of these people live, and what effect will this explosive growth have on travel patterns and fuel demand? Two upcoming Fuels Institute reports take a closer look.

|

The study on urbanization explores the effect of certain trends on vehicle ownership and fuel demand. Back in 1950, only 56% of Americans lived in metropolitan areas; but by 2010, that number had jumped to 84%. If this trend continues in lockstep with the population increase projected over the next 45 years, our urban centers are likely to become more densely populated and geographically large as they swell.

Urban planning activists are working to dramatically reduce the need for vehicle transportation, attempting to bring miles traveled from 60% down to 40%. Can they possibly be successful during a time of such great population increase? Regardless of the outcome, this effort to create multi-use, mass transit-friendly communities should not be overlooked for its potential effect on vehicle ownership and fuel demand.

Ride Sharing

As the population

grows and the country becomes increasingly urbanized, other trends will

also begin to emerge. A second Fuels Institute report looks closely at the

status of the ride-sharing economy in the United States. Admittedly, these

services are very much in their infancy. Four of the largest car sharing

services in the country boast a combined 25,000 vehicles in their

fleets—not even a speck of the overall vehicle population. However,

the potential for expanded utility is there.

As people gravitate to more populated urban areas, the challenges associated with parking and congestion will become more daunting and drivers will seek alternatives. Mass transit may try to keep pace, but history has shown that it has its limits. Opportunities abound for a new transportation option.

Car-sharing services such as Zipcar and car2go give people the ability to access a vehicle when and where they need it and for a much lower price than owning one of their own. And for drivers who do own a vehicle, many are beginning to realize that they use it only 5% of the time; the rest of the time it sits idle, incurring costs. Personal vehicle sharing through platforms such as Turo are creating an increasingly popular private market for vehicles owners (Think Airbnb for cars.)

The Outcome

These two studies will help put into context the potential direction vehicle ownership and fuel demand may follow over the next several decades. An acceleration in trends dating back to the 1980s could occur. Perhaps fewer people will get their driver’s license because lifestyle options will reduce the imperative for driving. Or maybe vehicle ownership rates will decline due to a combination of fewer drivers and the ability to rent “community” vehicles rather than own them outright.

The combined effect of these factors on fuel demand could be great. It is easy to say that car sharing will still result in significant miles traveled (just through fewer vehicles), but that overall fuel demand will not suffer more than expected through fuel economy improvements. This might be true if the car-sharing networks followed patterns consistent with nationwide vehicle registrations.

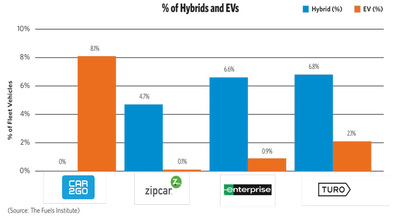

The car-sharing companies profiled in our report have more alternative fuel vehicles than the national average; the rate of hybrids or electric vehicles in their fleets range from 4.7%–8.1%. The Fuels Institute does not have a current report on the registration of these vehicles, but by comparison, according to WardsAuto, in 2015 hybrids, plug-in hybrids and electric vehicles combined accounted for just 2.8% of total light-duty vehicle sales.

It is critical to look at the big picture when thinking about the future of the transportation market. Too often we get stuck looking at specific technologies and the prospects of specific fuels. But when we think about these elements in a broader context, it becomes easier to understand where the market might be heading and how to best capitalize on opportunities that may present themselves.

For more information about the Fuels Institute or to get involved, contact John Eichberger, executive director, at (703) 518-7971 or email him at jeichberger@fuelsinstitute.org.