Can't Afford To Buy A New Car? You Are Not Alone

|

May 2014 Auto Buyer’s Affordability Index

Special To The Auto Channel

From Requisite Press, LLC

Analysis and Authorship; Phil Kelton

Discussion

Phil Kelton - author of "POWER SHIFT" |

June 11, 2014; The May 2014 Auto Buyer’s Affordability Index (ABAI) is 52.3 on a scale of 0 to 100. A score of 52.3 indicates that a U.S. median-income buyer following the 20-4-10 auto financing rule can only afford 52.3 percent of the May 2014 new-car average transaction price (ATP). This equates to a maximum affordable price of $15,763, assuming a median income of $52,959 and an ATP of $30,123.

While the May ABAI improved slightly from the April index of 52.1, the gap between the affordable and average prices remained greater than $14,000. The May ABAI increase was largely due to an ATP decrease, down 0.7 percent from last month.

The number of good choices is limited in the affordable scenario. In fact, none of the 21 cars listed (including runner-ups) in Kelley's Best Family Cars 2014 would qualify. Only 2 of 20 cars listed (including runner-ups) in Parents Magazine Best Family Cars of 2014 qualify.

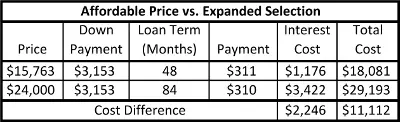

However, many additional models become accessible with a long-term loan. A $24,000 car financed with a 7-year loan, results in monthly payments similar to the affordable scenario. With this increased budget, the number of choices jumps to 9 of 21 and 12 of 20, respectively.

The increase in selection comes at a price to household financial security. While seeming to be affordable based on the monthly payment, a $24,000 car financed for seven years would drive up the overall cost by more than $11,000, including more than $2,200 in additional interest cost.

The trade-off between selection and financial security seems to be tipping toward selection with growing regularity.Experian Automotive reported recently that loans with terms of 73-84 months grew by 27.6 percent in the last year. In addition, the average amount financed for a new-vehicle loan reached an all-time high of $27,612 in Q1 2014.

The monthly ABAI was developed to enable buyers to easily view current new-car prices in the context of sound financial advice. The 20-4-10 auto financing rule consists of a minimum 20 percent down payment, a maximum 4-year loan term, and monthly payments of no more than 10 percent of gross household income. The rule is widely recommended by personal finance experts to maintain financial security, avoid excessive interest costs, and preserve future investment opportunities.

Note: Both use an APR of 4.08% and sales tax rate of 7.24%. |

Methodology:

An affordable price monthly payment (including principal and interest) was calculated by taking 10 percent of the U.S. monthly median household income, and subtracting a U.S. average monthly insurance premium. For an income of $52,959 and a monthly insurance premium of $130, the affordable monthly payment is $311.

An affordable price was then calculated using the affordable payment, along with a U.S. average 48-month auto loan interest rate, and a U.S. average sales tax rate. A 20 percent down payment was assumed. For a payment of $311, an interest rate of 4.08 percent, and a sales tax rate of 7.24 percent, the affordable price is $15,763.

The May 2014 ABAI was calculated by dividing the affordable price of $15,763 by the average transaction price of $30,123, and then multiplying by 100.

The affordable price result can easily be validated using any number of online calculators. Two examples, along with associated inputs, are shown below:

Interest.com–Calculate for: Purchase Price, Monthly payment: $311, Term in months: 48, Interest Rate: 4.08%, Rebates and Cash Down: $3,152.69, Trade allowance: $0.00, Amount owed on trade: $0.00, Fees (non-taxable): $0.00, Fees (taxable): $0.00, Sales tax rate: 7.24%.

Returns a Total Purchase Price (before tax) of $15,763.42

Cars.com–Monthly Payment: $311, Down Payment: $3153, Trade-in Value: $0, Sales Tax: 7.24%, Interest Rate (APR): 4.08%, Term (Months): 48

Returns a Vehicle Price of $15763

Sources:

New Car Average Transaction Price

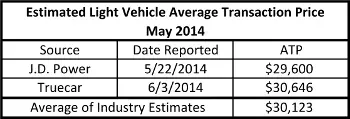

The average transaction price reference used in the May 2014 index is $30,123. The price reference is an average of estimates by J.D. Power and Truecar.

|

U. S. Median Household Income

The median household income used for the May 2014 index is $52,959. The median household income is published by Sentier Research, LLC on a monthly basis based on the Current Population Survey data. There is a one-month lag in publishing the data, so the latest available data for the May index is from the April 2014 Current Population Survey and was derived and published by Sentier Research, LLC on May 30, 2014.

U.S. Average 48-Month Auto Loan Interest Rate

The interest rate used in the May 2014 index is 4.08 percent. The interest rate is the national average 48-month interest rate for May 15, 2014 published by Bankrate.com based on a weekly survey of large banks and thrifts. Bankrate.com does not keep an archive of past 2014 rates. However, the Bankrate.com rates for May 15th can be found at Yahoo.com.

U. S. Average Insurance Premium

The insurance premium used in the calculation of the May 2014 index is $130 per month. The premium is based on state average insurance premiums published by Insure.com for 2014, and then weighted by state population to develop a national average. The state population estimates are from the Census Bureau’s Population Estimates Program, Annual Estimates of the Resident Population: April 1, 2010 to July 1, 2013, 2013 Population Estimates (ID PEPANNRES).

U. S Average Sales Tax Rate

The sales tax rate used in the calculation of the May 2014 index is 7.24 percent. This rate is based on state average combined sales tax rates published by the Tax Foundation for 2014, and then weighted by state population to develop a national average. Population numbers used were identical to those used for the insurance premium calculation.