Used Car Value Shrinkage From Blackbook

Depreciation Trends Normalize

Black Book Market Insights presents in-depth analysis of used car and truck valuation trends and insights straight from the auction lanes. Click here to download the full report.

This week’s Market Insights Report looks at how depreciation trends may be showing early signs of spring, with two truck segments actually showing no depreciation last week. The report also highlights all the specialty vehicle trends, as well as a look at residual value forecasts, which remain strong on pickup trucks while luxury cars and sub-compact cars show relative weakness.

“We are starting to see a normalization in depreciation after higher drops at the start of the year. Both car and light truck segments are showing stability in values,” said Anil Goyal, Executive Vice President, Operations, for Black Book.

- Volume-weighted, overall car segment values decreased by 0.56% last week. In comparison, the market values decreased by 0.65% on average during the prior 4-week period.

- In car segments, the depreciation across segments was quite steady.

- Volume-weighted, overall truck segment (including pickups, SUVs, and vans) values decreased by 0.42% last week. In comparison, the market values decreased by 0.58% on average during the prior 4-week period.

- In truck segments, the Compact Crossover/SUV segment depreciated the most.

Specialty Used Car Markets

Collectibles: The final sales numbers from the collectible car auctions held in Arizona are in, and they’re impressive…the total for roughly ten days of sales was just over a quarter of a billion dollars.

Recreational Vehicles: We are solidly into winter now, and brutally cold weather has gripped large parts of the country. Although the volume of vehicles offered at auction has dropped, as we’d expect for this time of year, the values of those that were sold actually increased a little bit for both towables and motorized units.

Powersports: values are still frozen in negative territory this month. The changes in value we see for February are very similar to the changes from January.

Heavy Duty: Used trucks of all ages dropped more across all segments than last month but are still doing very well.

Medium Duty: Increased demand has helped offset price depreciation as a steady supply of used inventory continues through January.

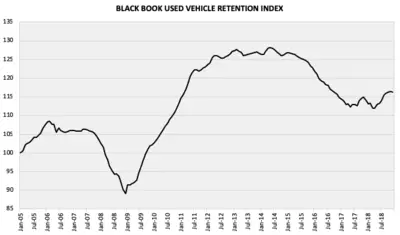

The Black Book Used Vehicle Retention Index is calculated using Black Book’s published Wholesale Average value on two- to six-year-old used vehicles, as percent of original typically-equipped MSRP. Black Book’s Wholesale Average is a benchmark value for used vehicles selling in the wholesale auctions with the vehicle quality in Average condition. The index is weighted based on used vehicle registration volume and adjusted for vehicle age, mileage, condition, and inflation (MSRP).

Aggregated from daily vehicle value updates, and captured throughout hundreds of wholesale physical and online auto auctions across the country, the Black Book Used Vehicle Retention Index represents data across all regions of the U.S. The Index is based on a comprehensive list of vehicles included in the Black Book wholesale database, and includes no bias toward any brand, auction or region, ensuring a more accurate reporting of the used vehicle market.

Click below to download the Black Book Used Vehicle Retention Index, updated January 2019.