Technavio publishes a new market research report on the global automotive telematics market from 2016-2020. (Graphic: Business Wire)

Download

- Full Size

- Small

- Preview

- Thumbnail

Technavio publishes a new market research report on the global automotive telematics market from 2016-2020. (Graphic: Business Wire)

-

Full Size

-

Small

-

Preview

-

Thumbnail

-

-

Full Size

-

Small

-

Preview

-

Thumbnail

-

LONDON—Technavio has announced the top five leading vendors in their recent global automotive telematics market report. This research report also lists 18 other prominent vendors that are expected to impact the market during the forecast period.

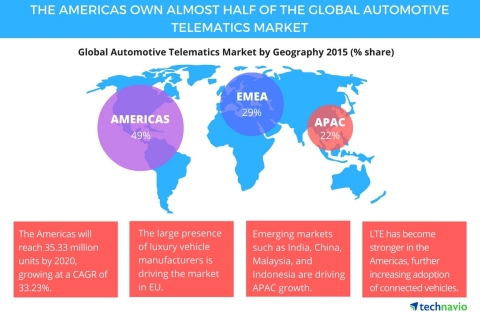

The global automotive telematics market will produce 73.66 million units by 2020, growing at a CAGR of close to 34%. In terms of units sold, the analysts from Technavio expect the demand for automotive telematics to grow at an exponential pace. The market is driven by the increased integration of smartphones in automobiles to enhance the in-vehicle experience of drivers and passengers. The rising demand among consumers for connectivity of automobiles with other vehicles is also boosting the market growth.

Competitive vendor landscape

The global automotive telematics market is fragmented with the presence of many vendors. The market is growing because of the growing integration of smartphones or tablets with automobiles to improve the in-vehicle experience of the driver and passengers.

“In addition, the increasing collaboration of the automotive telematics market and the automobile insurance industry has boosted the market growth. Moreover, the introduction of automotive telematics in EVs is also expected to propel the market growth in the coming years,” says Siddharth Jaiswal, a lead automotive electronics analyst from Technavio.

Request a sample report: http://www.technavio.com/request-a-sample?report=54503

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Top five automotive telematics market vendors

Agero

Agero offers products such as electronic vehicle mobile charger, motor club, and fleet services; safety and security solutions; OneRoad, a platform that leverages various technologies, including interactive voice response unit (IVRU)/speech, geographic information system (GIS), and mobile technologies; Roadside Connect, which provides motorists with real-time route status updates of a service provider’s progress to their location; and VINpoint, which offers location information. The company also provides accident scene management and vehicle release services; warranty, insurance, and service contract/delivery assistance; field information services; and consumer affairs and perks to execute recall campaigns, mitigate public relations issues, and build or repair customer relationships.

Airbiquity

In 2014, the company partnered with content providers such as Slacker Radio, Stitcher, Reuters, and Yelp. Airbiquity is focusing on the expansion of its portfolio to provide automotive and personal navigation device (PND) manufacturers with the most cost-effective, flexible, and reliable ecosystem for content and services. It offers several connectivity solutions ranging from packet data to SMS. The company's offers its flagship aqLink in-band modem, and its connected services deliver an end-to-end solution for in-car connectivity. These customized offerings can be implemented on both fully embedded wireless modules in cars and PND devices through a Bluetooth connection by using an existing mobile phone to deliver a full array of services.

Continental

Continental is one of the world's largest automotive manufacturing companies that manufactures, develops, and sells passenger cars, light trucks, industrial tires, and other related products.

The company also specializes in tachographs, brake systems, tires, automotive safety, powertrain components, chassis components, and other parts used in the automotive and transportation industries. The company primarily involves in the production of soft rubber products, rubberized fabrics, and solid tires for carriages and bicycles.

Verizon Telematics

Verizon Telematics provides real-time voice and data communication services to its customers. The company is expanding its market presence in the telematics market by offering a variety of products. Verizon Telematics also focuses on the connected car market.

Visteon

Visteon was established as a wholly owned subsidiary of Ford Motor Company in 2000. The company separated from Ford on June 28, 2000. It is a global supplier of automotive electronics and Fortune 500 company. The company provides vehicle components, modules and electronic components to BMW, Ford, Daimler, and GM.

Browse Related Reports:

- Global Commercial Telematics Market 2016-2020

- Commercial Vehicle Telematics Market in India 2016-2020

- Commercial Vehicle Telematics Market in the Americas 2015-2019

Do you need a report on a market in a specific geographical cluster or country but can’t find what you’re looking for? Don’t worry, Technavio also takes client requests. Please contact enquiry@technavio.com with your requirements and our analysts will be happy to create a customized report just for you.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 630 333 9501

UK: +44 208 123 1770

www.technavio.com