New-Car Affordability Idles, Even as Incentives Rise to Record Levels, Says Requisite Press

SEE ALSO: Monthly Payment Guide

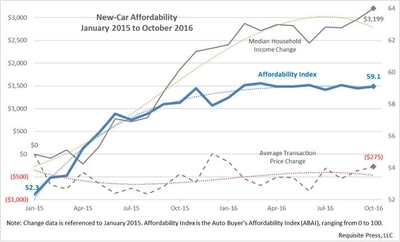

LOS ANGELES, Nov. 17, 2016 -- Requisite Press, LLC reported today an October 2016 Auto Buyer's Affordability Index (ABAI) of 59.1, indicating that a prudent, median-income household can afford 59.1 percent of the light-vehicle average transaction price (ATP). The index increased marginally this month from September's value of 59.0. Affordability gains have stalled this year as income growth has slowed, even as automakers have increased incentives to record levels. Regardless of overall affordability, informed consumers can significantly improve the affordability of their own purchase. To that end, Requisite Press has released The 15-Minute Guide to Negotiation-Free New Car Buying e-book.

The index has stalled at around 59 for most of this year after rising rapidly in 2015. The key driver of last year's affordability gains—income growth—has slowed significantly this year. Median household income (MHI) has increased by only $795 so far this year, compared to a $1,862 increase over the same period in 2015.

Automakers, faced with plateauing new-car sales, have increased incentives to record levels, essentially keeping a lid on transaction prices. The October ATP was up only 0.5 percent year-over-year. However, due to the income slowdown, median-income car buyers have largely missed out on affordability gains.

"Transaction prices continue to be essentially flat this year, but income growth has all but disappeared," said Phil Kelton (@Phil_Kelton), President of Requisite Press. "However, even as overall affordability stalls, savvy car buyers can still boost the affordability of their own purchase (and improve the buying experience)."

Requisite Press recommends that consumers employ a simple strategy for a better car-buying outcome: prepare to buy immediately, broadcast a nonnegotiable sales opportunity directly to multiple dealers, and buy from the best. The strategy, along with instruction and rational, has been detailed in a newly released e-book—The 15-Minute Guide to Negotiation-Free New Car Buying: Simply Save More and Stress Less.

The e-book is available at: https://carswithease.com.

The October 2016 ABAI of 59.1 is based on a median household income of $57,616, a light-vehicle average transaction price of $31,076, and adherence to the 20-4-10 auto financing rule. This equates to an affordable monthly payment of $364 and price of $18,373.

The monthly ABAI was developed to enable buyers to easily view current new-car prices in the context of sound financial advice. The 20-4-10 auto financing rule consists of a minimum 20 percent down payment, a maximum 4-year loan term, and monthly payments of no more than 10 percent of gross household income (including insurance). The rule is widely recommended by personal finance experts to maintain financial security, avoid excessive interest costs, and preserve future investment opportunities.

The index is published each month, along with additional information and analysis, at the following location:

http://www.requisitepress.com/ABAI

Requisite Press, LLC, founded in 2012, publishes consumer-focused car-buying information and resources. In addition to publishing the monthly Auto Buyer's Affordability Index and car-buying guidebooks, Requisite Press also provides AffordCheck (SM), a free, online affordability calculator based on the 20-4-10 auto financing rule.